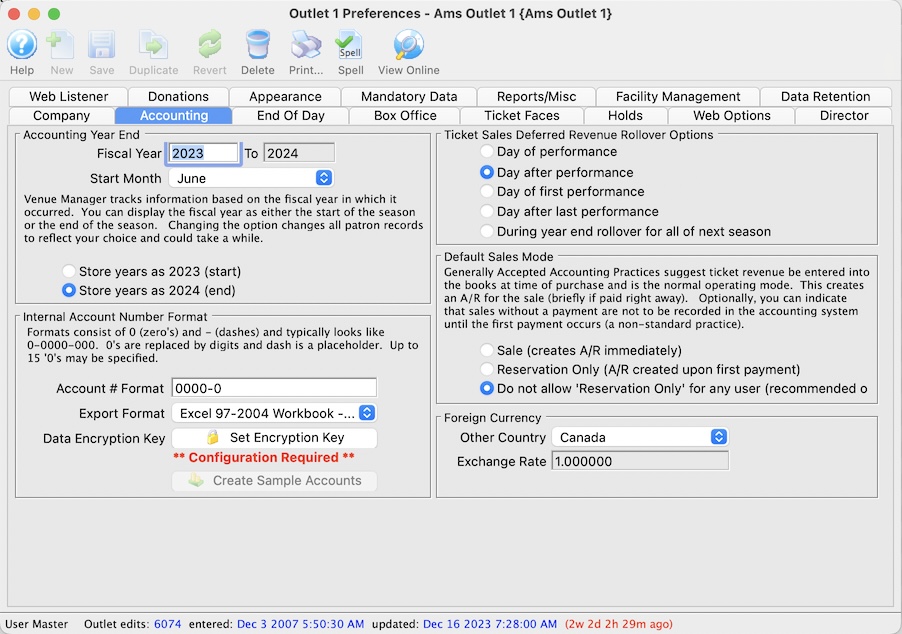

Accounting Tab

General Accounting Information |

|||

| Fiscal Year | This is the fiscal year that the company is currently in. This can be altered by clicking in the field and retyping the year if it is wrong.

If you are ending one fiscal year and beginning another, you must use Year End Rollover (instead of changing the fiscal year. |

||

| Month Start | This is the month that the company's new fiscal year starts in. This can be altered by clicking in the field and retyping the month. If the fiscal start month is changed after sales information has been posted to the General Ledger accounts, it may be necessary to Recalculate General Ledger Totals.

|

||

| Store Years As - Start |

If selected: the year stored in the GL will be the year at

the beginning of the fiscal year. i.e. 2015/2016 fiscal year dates

will be stored as 2015. This also applies to the data in the supporting records.

For example a donation with fiscal year of 2016 means that the donation will be for the 2016-2017 season. You would search for donations in 2016 to find them. |

||

| Store Years As - End | If selected: the year stored in the GL will be the year at the end of the fiscal year. i.e. 2015/2016 fiscal year dates will be stored as 2016.

For example, a gift certificate in the 2013-2014 year will be marked as 2014 (the end of the fiscal year). You would search for gift certificates for year 2014 to find them) |

||

Internal Account Number Format |

|

| Account # Format | Allows the account number to be up to 15 digits, excluding dashes, in any combination of numbers and dashes. |

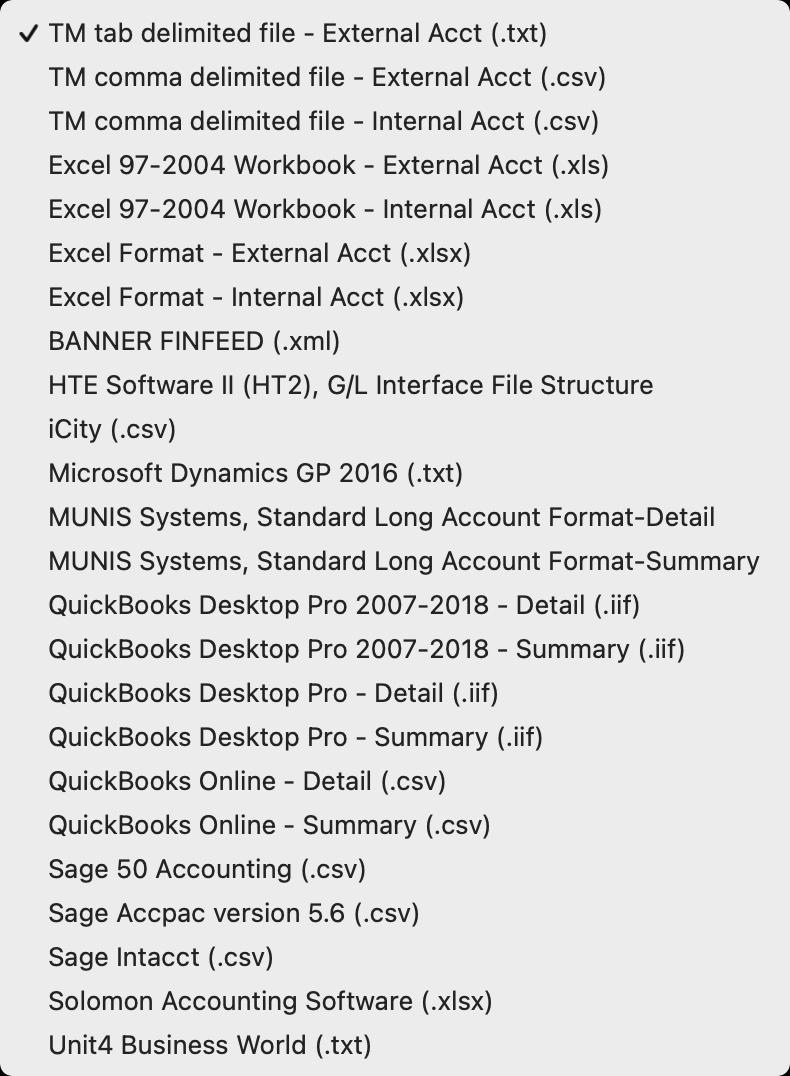

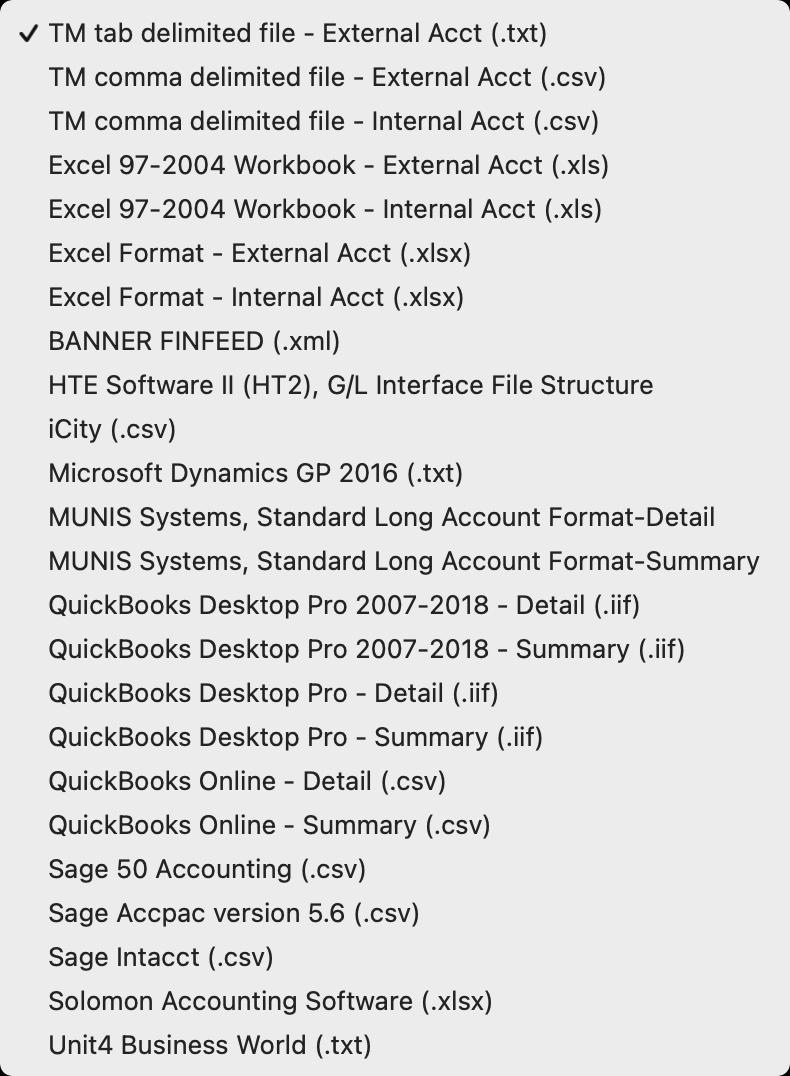

| Export Format |

Select the Export Format to use for exporting GL entries that is most compatible with your accounting software. Options include:

Select the Export Format to use for exporting GL entries that is most compatible with your accounting software. Options include:

|

|

This button will create a set of sample accounts if no accounts have been setup under Accounting >> G/L Accounts. |

|

This button will edit the Data Encryption Key used for Data Encryption Proocesses. |

Ticket Sales Deferred Revenue Rollover Options |

|

| Day of Performance | Moves money for the performance from Deferred to Sales on the day of the performance. |

| Day after Performance | Moves money for the performance from Deferred to Sales on the day after the performance. |

| Day of First Performance | Moves money for the play from Deferred to Sales on the day of the first performance. |

| Day after Last Performance | Moves money for the play from Deferred to Sales on the day after the last performance date. |

| During year end rollover for next season | Moves money for the play from Deferred to Sales on the during the year end rollover. |

Default Sales Mode |

|||

| Sale | Adds transactions to the Accounts Receivable ledger immediately. | ||

| Reservation Only |

Financial transactions are not created in the general ledger until the order has one or more of the following events happen to it:

If you allow this feature, you may wish to set a preference for each employee for their default during order creation.

|

||

| Do not allow 'Reservation Only' | Will prevent the 'Reservation Only' option from appearing at checkout. This is the PREFERRED option | ||

Foreign Currency |

|

| Other Country | This is where an optional country can be selected for accepted foreign currency when selling tickets. If the organization does not accept foreign currency, set the country to the "home" country. |

| Exchange Rate | This is where the exchange rate for converting from the local currency to the currency of the foreign country is entered. If the organization does not accept foreign currency, set the exchange rate to 1.000000. |

Export Format Options

|

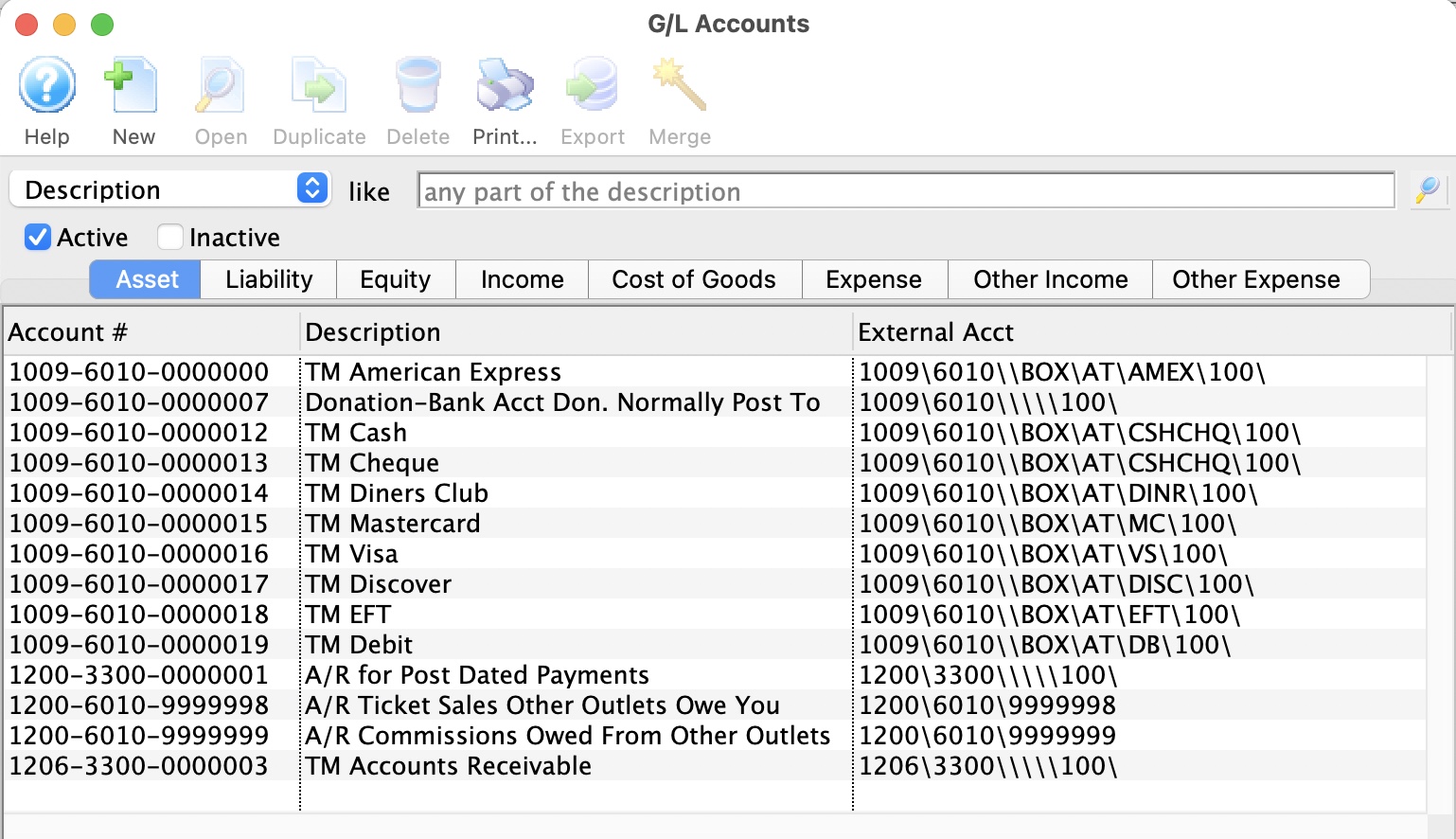

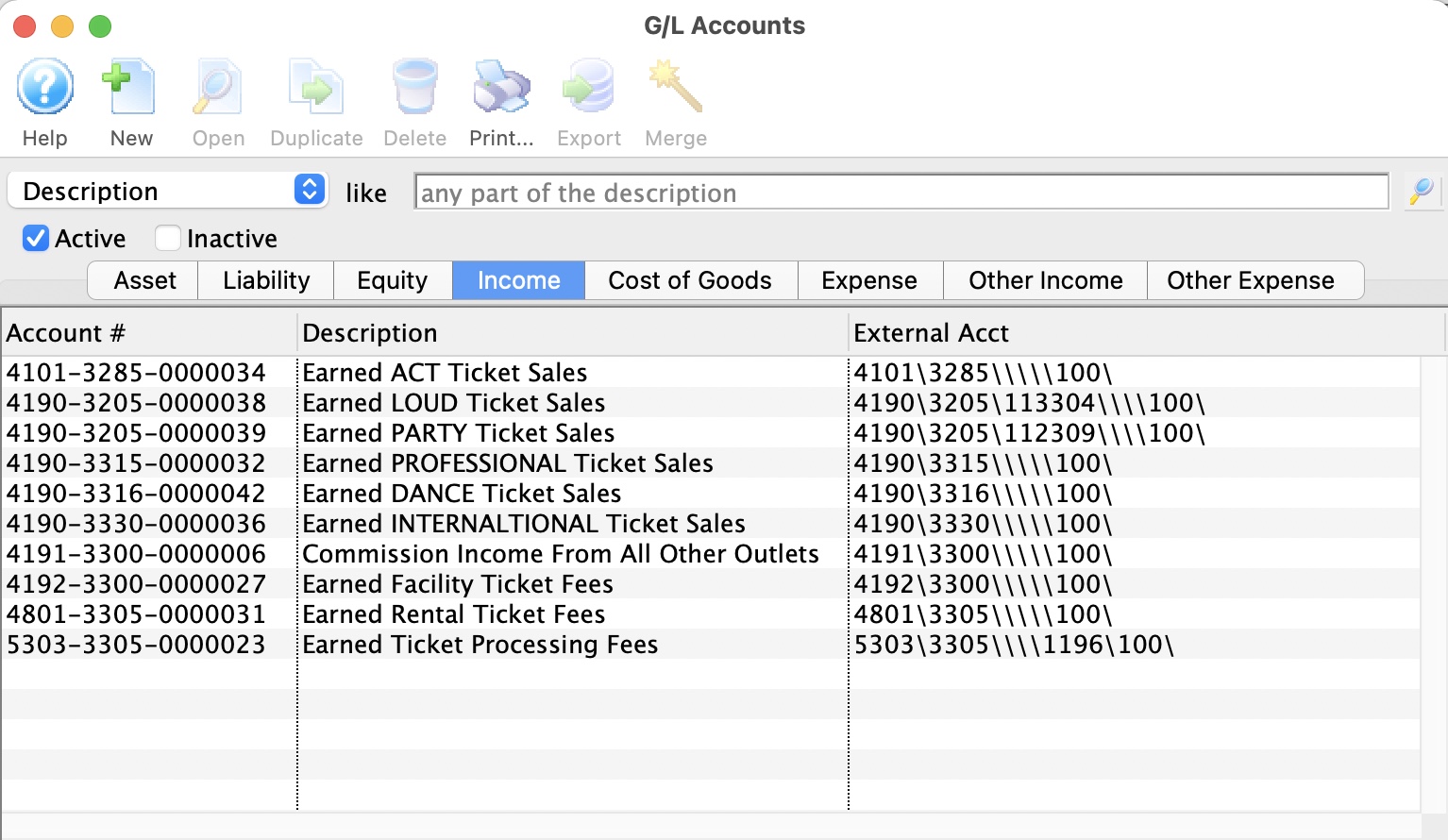

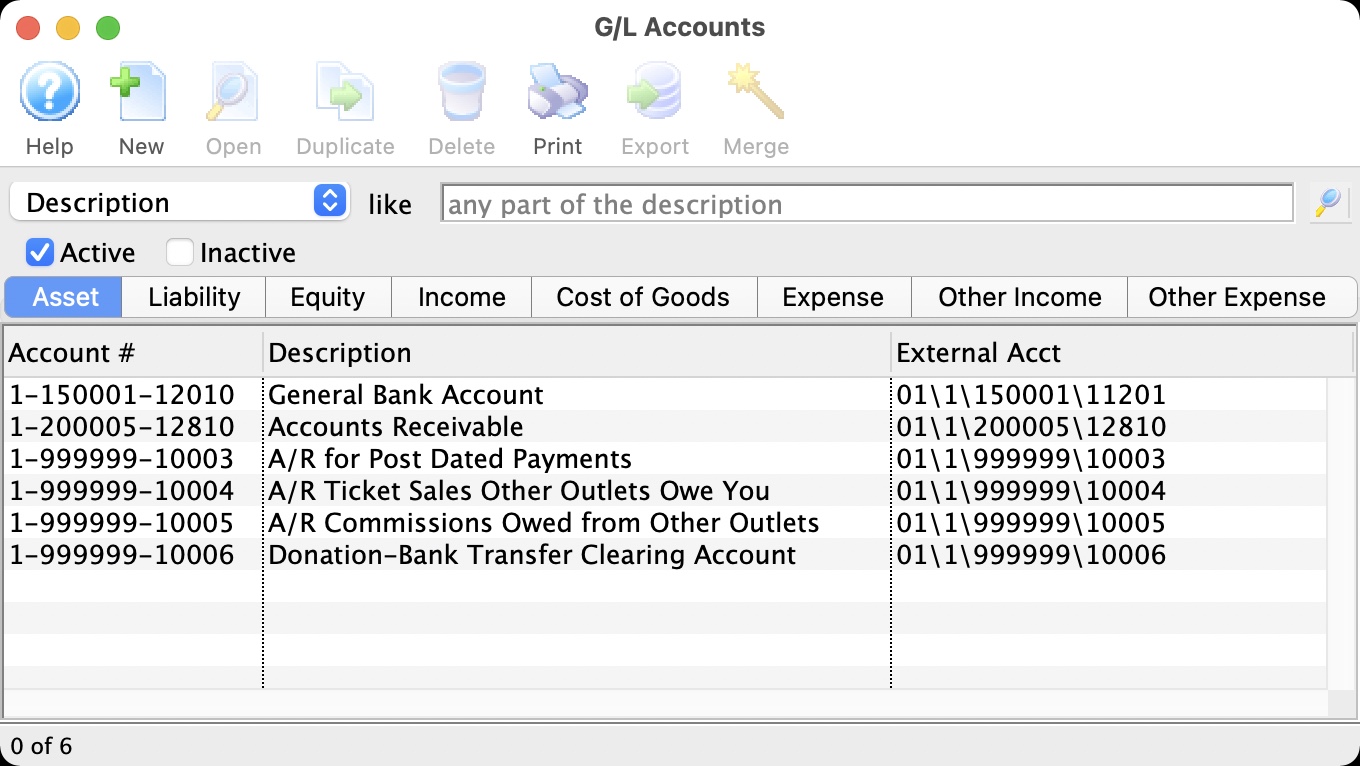

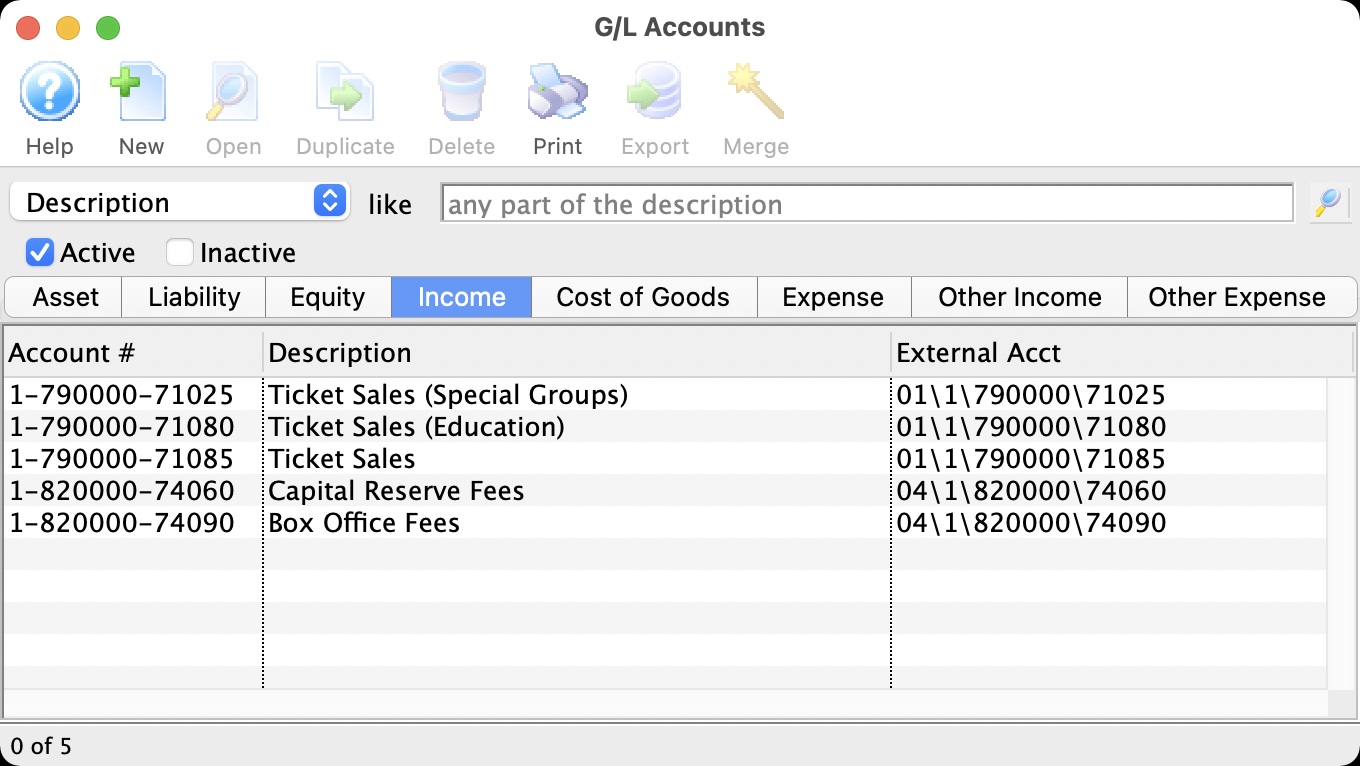

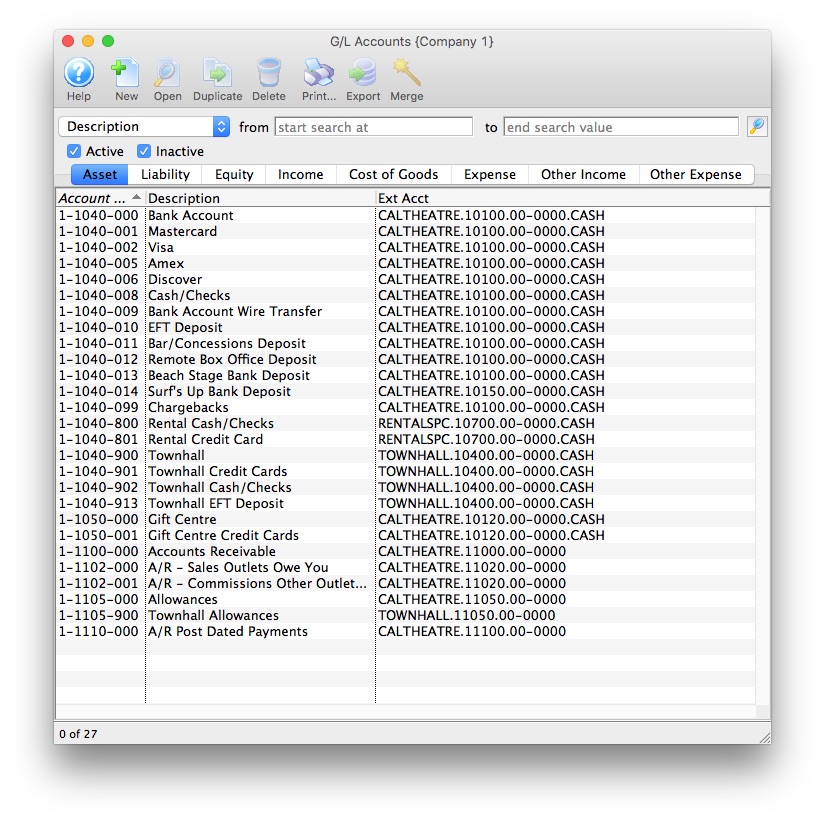

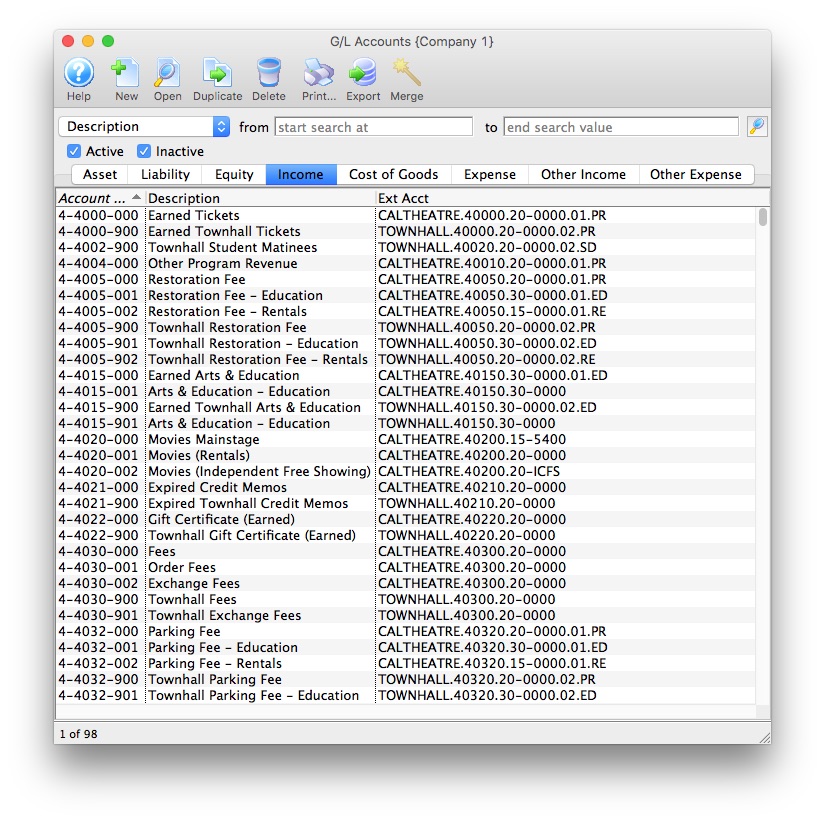

If you are exporting your data to an external accounting package, ensure you have set up the External Account information in GL Account Setup . The software uses the External Account information as the default format for your accounting system. |

|

Select the export format you want to use in the company preferences accounting tab

Select the export format you want to use in the company preferences accounting tab

Export formats supported are to the right. They are explained in detail in the help pages that follow. |

|

The GL Reports can only be exported once a day. The GL Entry is flagged as being exported when it is done via the EOD Wizard so it's not exported twice by mistake. |

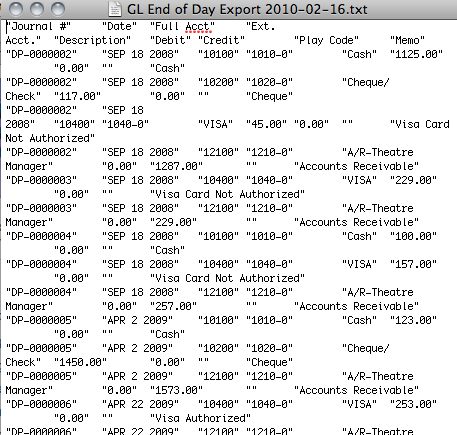

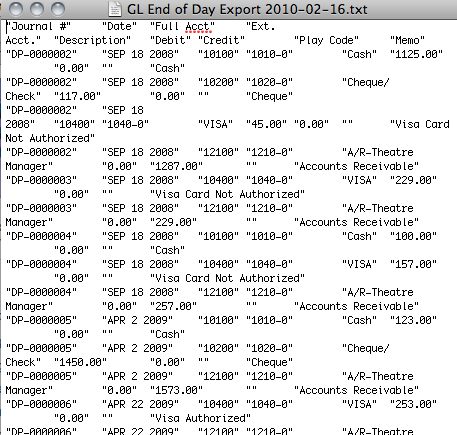

Tab Delimited

Tab Delimited Export Format

TM Tab Delimited File format works with most accounting packages and with Microsoft Excel.

Comma Delimited

Comma Delimited Export Format

TM Comma Delimited File format works with most accounting packages and with Microsoft Excel. Each field is separated by a comma.

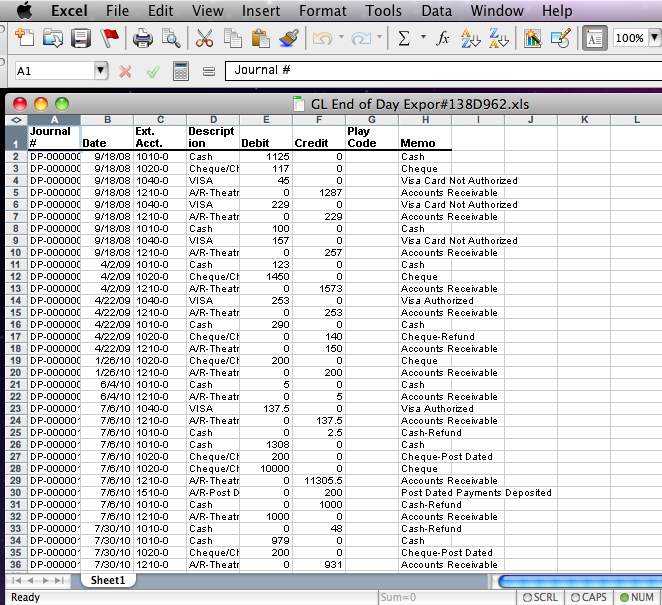

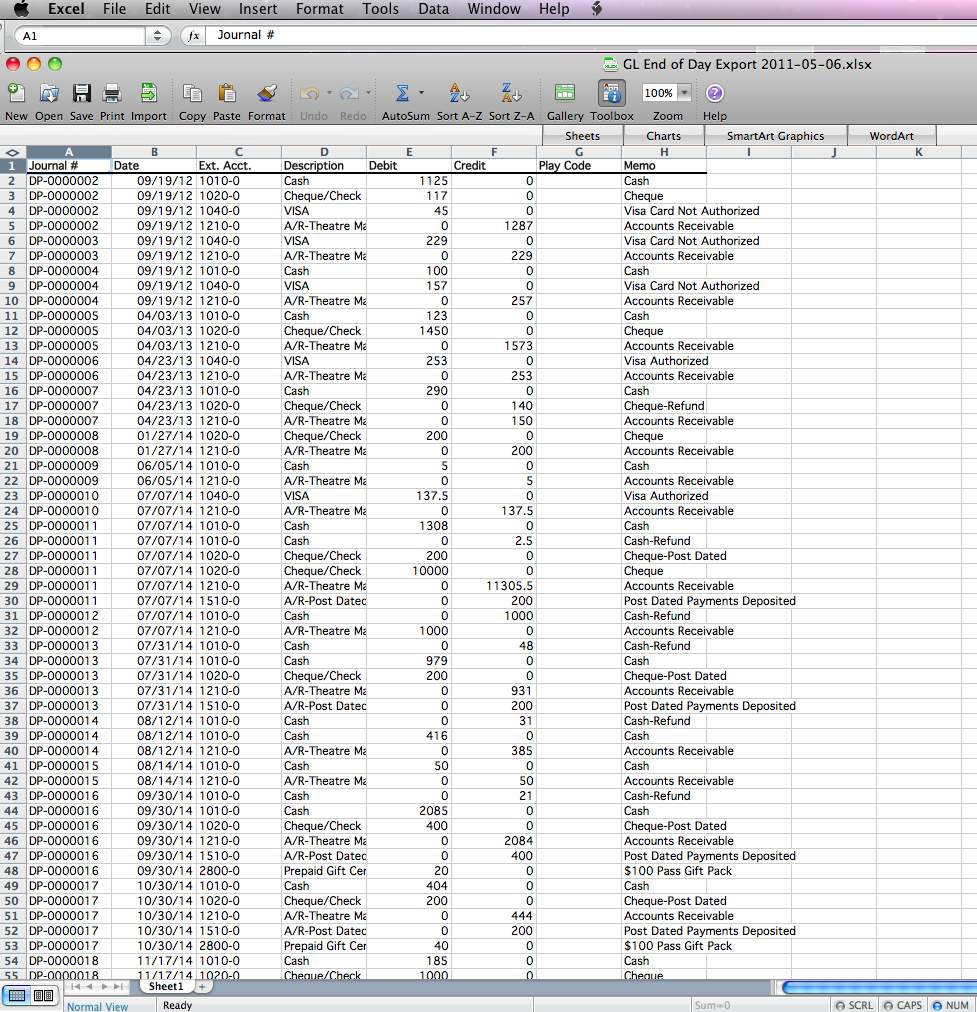

Excel

Microsoft Excel

Excel Workbook 97-2004 creates a .xls export file that can be opened directly in Microsoft Excel versions 97 through 2004 with no need for conversion.

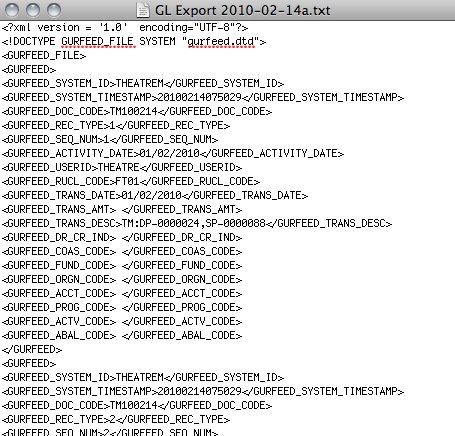

Banner

Banner FINFEED

Banner FINFEED creates an XML export file for use with the Banner financial package. If your organization uses Banner, then select this option.

HTE Software II

HTE Software II (HT2), G/L Interface File Structure

HTE Software II (HT2), G/L Interface File Structure creates a fixed position file format.Microsoft Dynamics GP 2016

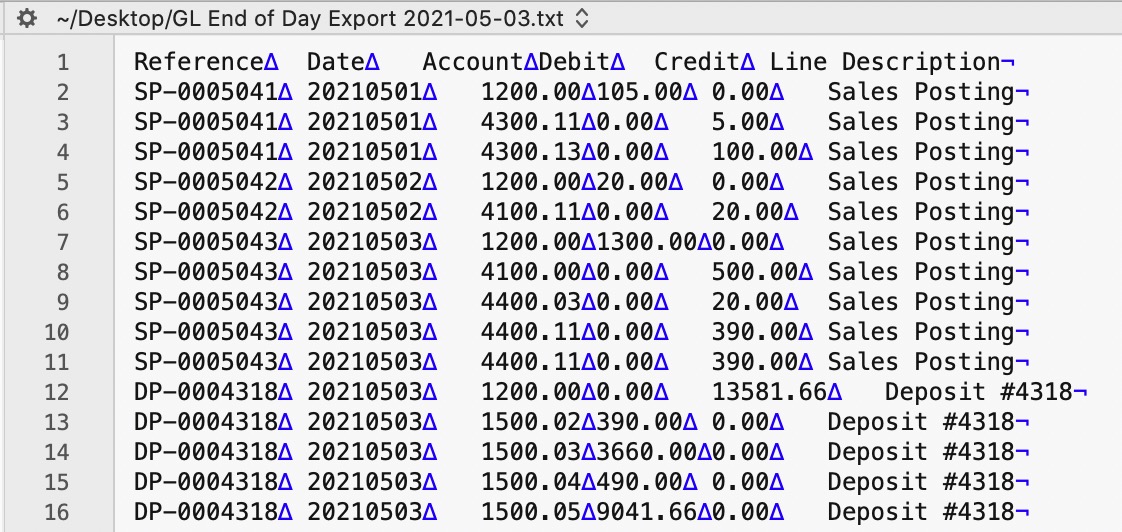

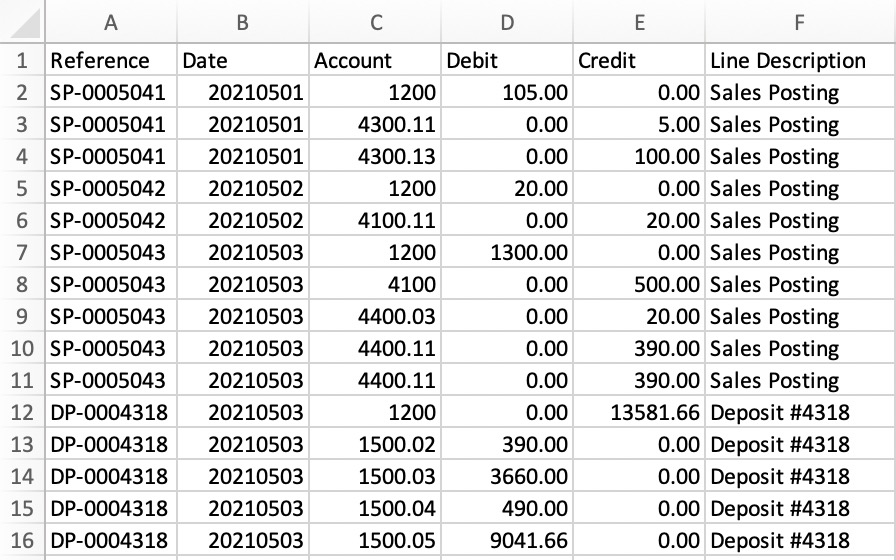

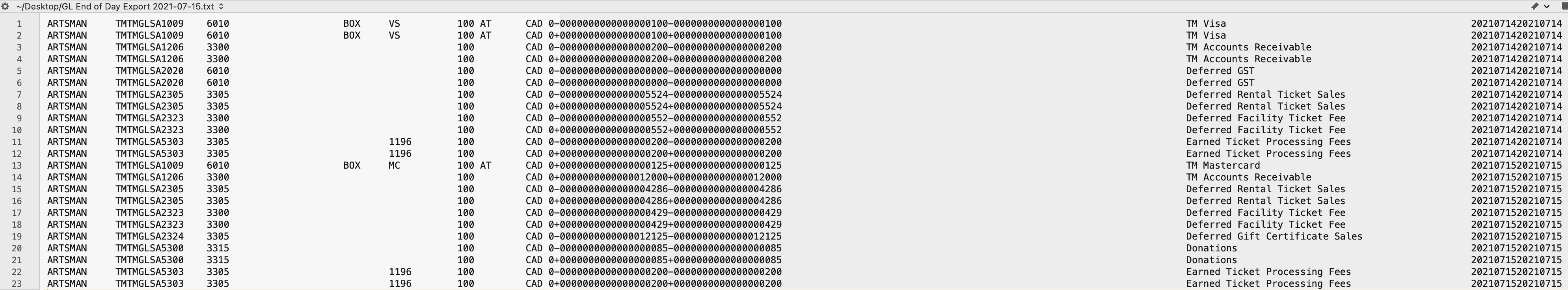

Microsoft Dynamics GP 2016

The Microsoft Dynamics GP 2016 exports a tab-delimited text file containing an export line for each detail line within the G/L Entry. The deposit and sales posting are combined and exported within the same export file. This allows an exact match of each G/L Entry to crossover into Microsoft Dynamics GP 2016 accounting software (line for line).

Parts of the Microsoft Dynamics GP 2016 Export File

| Reference | Journal Entry Reference Number. The Journal Number for this G/L Entry (SP-0005041, DP-0004318, GL-2021122) |

| Date | The Journal Entry Date. The date is always in YYYYMMDD format. |

| Account | Theatere Manager's External Account value (name or number) will be used to create the export file. |

| Debit | The Debit amount for this G/L Detail Line. |

| Credit | The Credit amount for this G/L Detail Line. |

| Line Description | The Journal Entry Description for this G/L Entry (Sales Posting, Deposit Posting). |

iCity

|

Theatre Manager will create a comma-delimited text file (.csv) that can be used to import into iCity accounting software. iCity's ability to create unique funds, classes, departments, and objects for each GL account requires the setup of Theatre Manager's External Account field to be set in a specific format to accomodate the various aspects of the iCity export file, prior to performing the first export. |

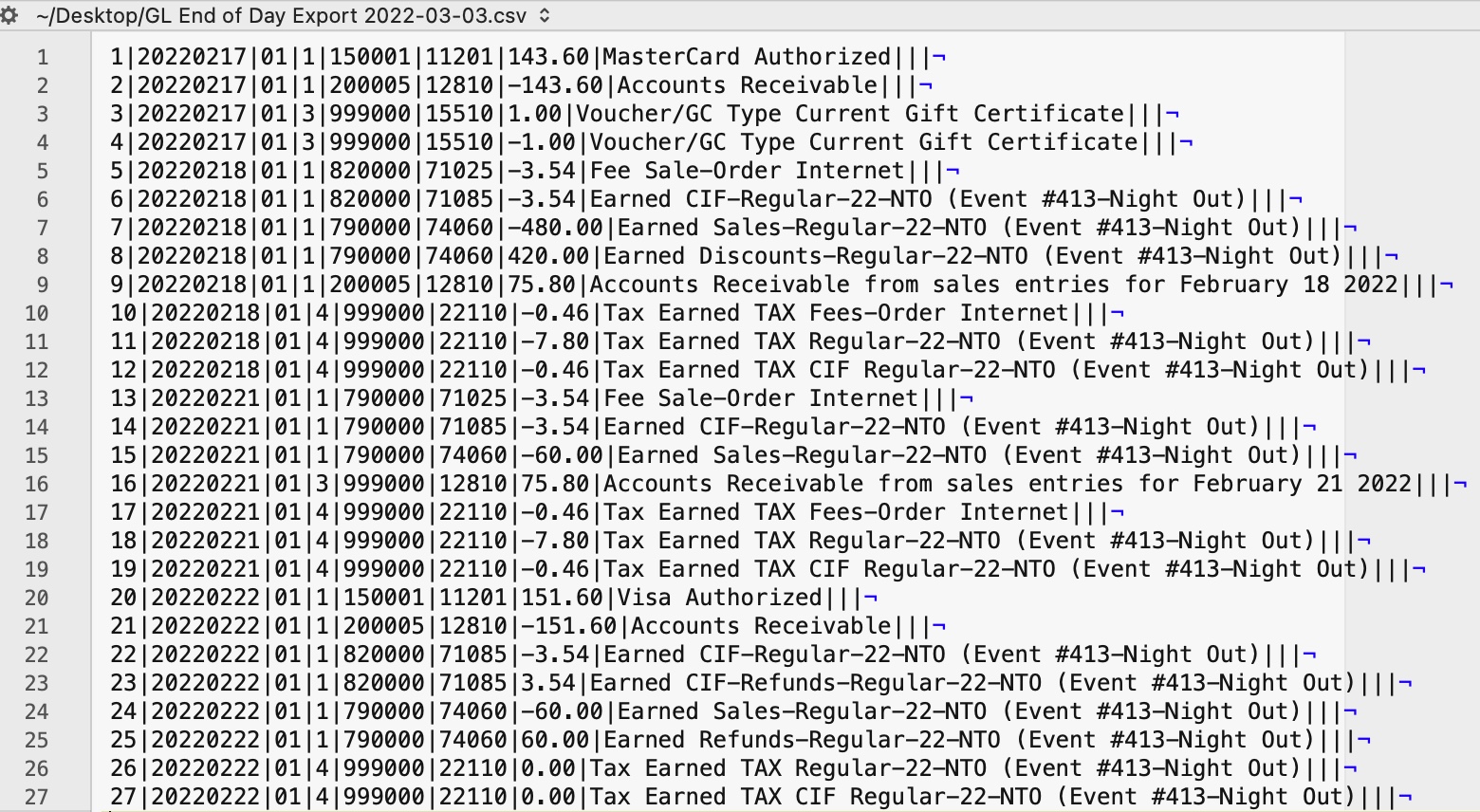

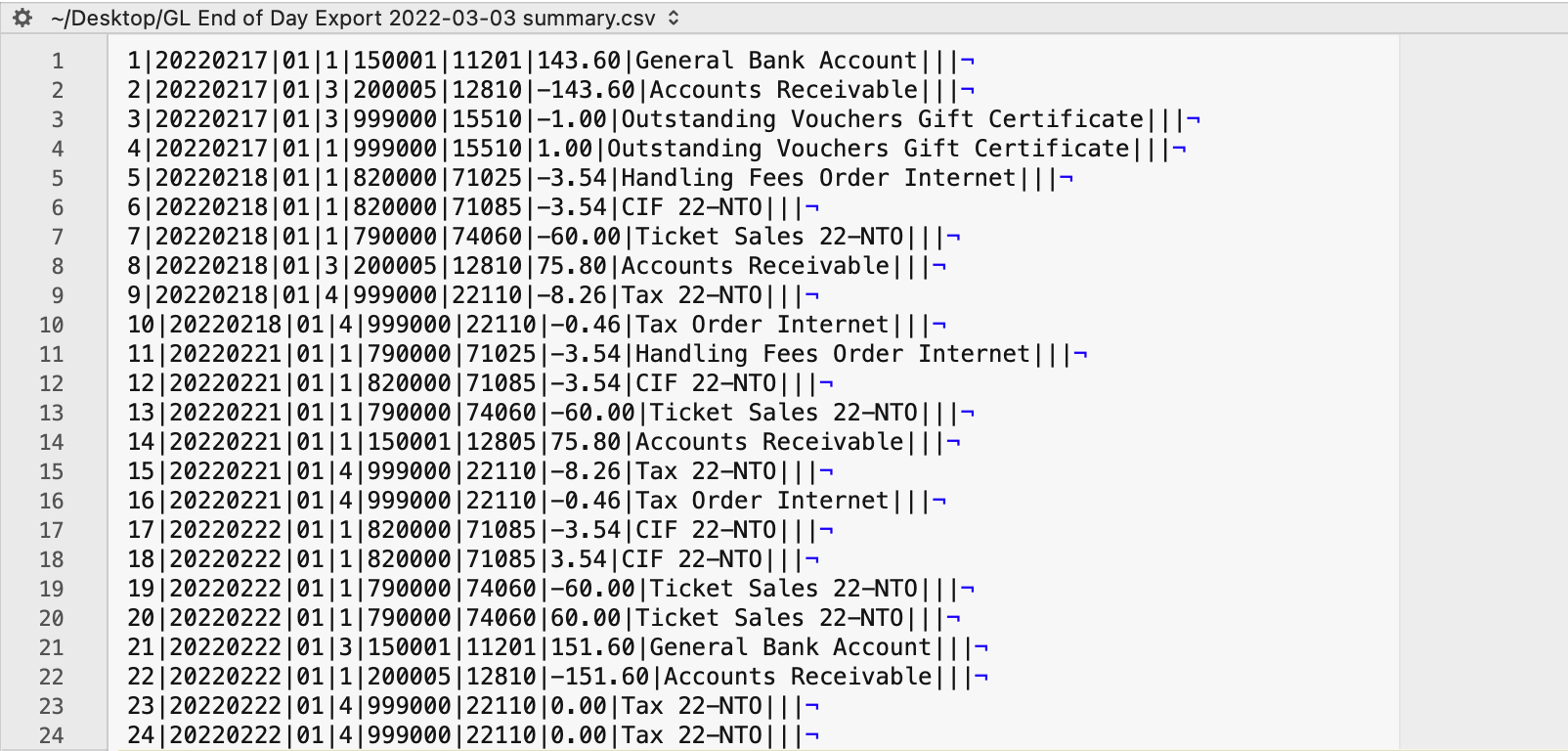

iCity Accounting Software - Detail

The iCity - Detail format will export each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entry within the export file. This allows an exact match of each G/L Entry to crossover into iCity (line for line).

iCity Accounting Software - Summary

The iCity - Summary export creates a summarized version of the deposit and sales postings for each posting date. The deposit and sales postings lines are summarized into a single entry for each posting date within the export file.

Parts of the iCity Export File

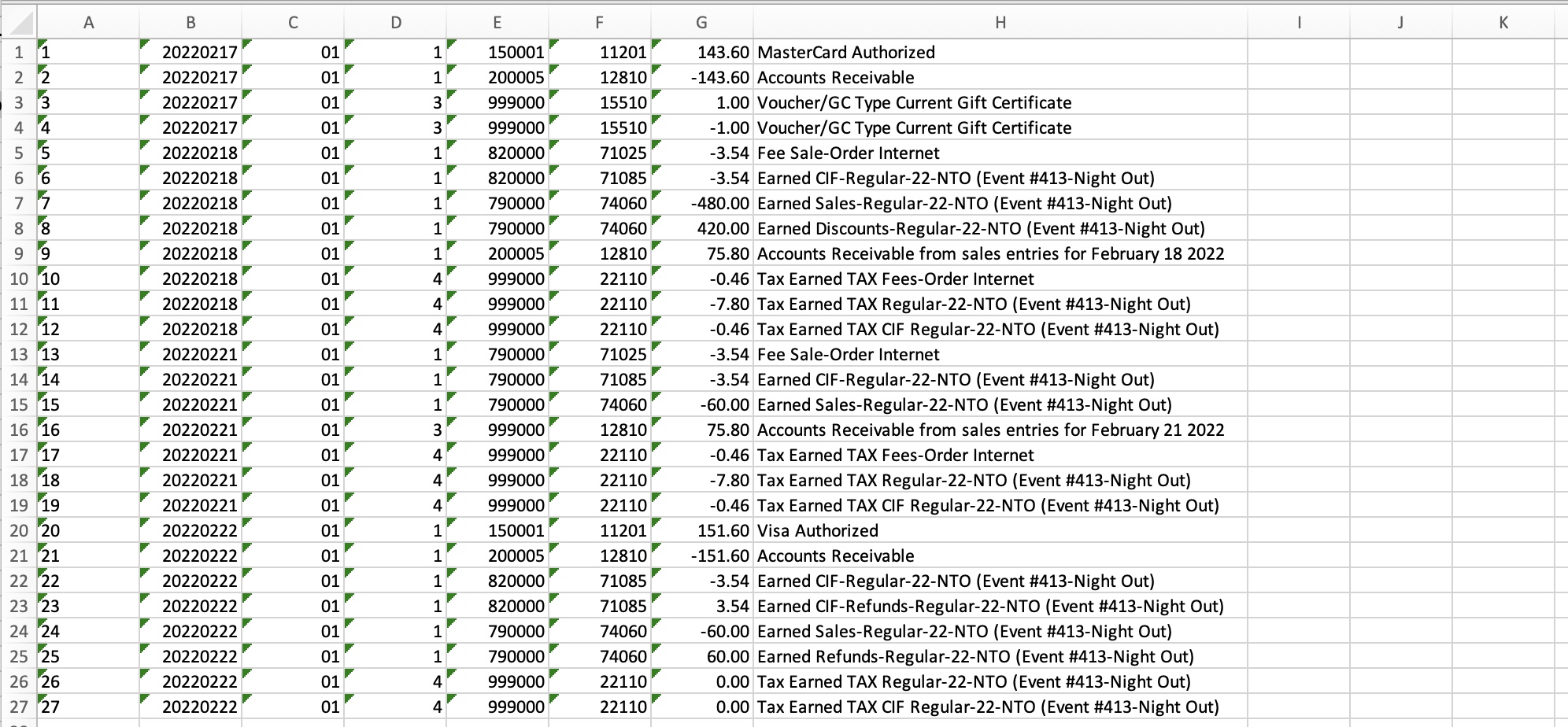

| Voucher ID | A sequential Line Counter for each exported entry line. Line numbers begin at 1 and increment by 1 for each associated entry line. |

| Date | The Journal Entry Date for this G/L Entry. The date will be in a YYYYMMDD format. |

| Fund | An associated Fund Code to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file. |

| Class | An associated Class Code to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file. |

| GL Department / Category | An associated Department/Category Code to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file. |

| Object | The iCity account number. Theatere Manager's External Account value (name or number) will be used to create the export file. |

| Amount | The debit amount (represented as a positive value) or the credit amount (represented as a negative value) of the transaction. |

| Description | The memo text for this G/L Detail Line.

|

| Cost Centre 1 | An associated Cost Center ID to the Account Number.

Theatre Manager does not populate this field during the export process. |

| Cost Centre 2 | An associated Cost Center ID to the Account Number.

Theatre Manager does not populate this field during the export process. |

| Cost Centre 3 | An associated Cost Center ID to the Account Number.

Theatre Manager does not populate this field during the export process. |

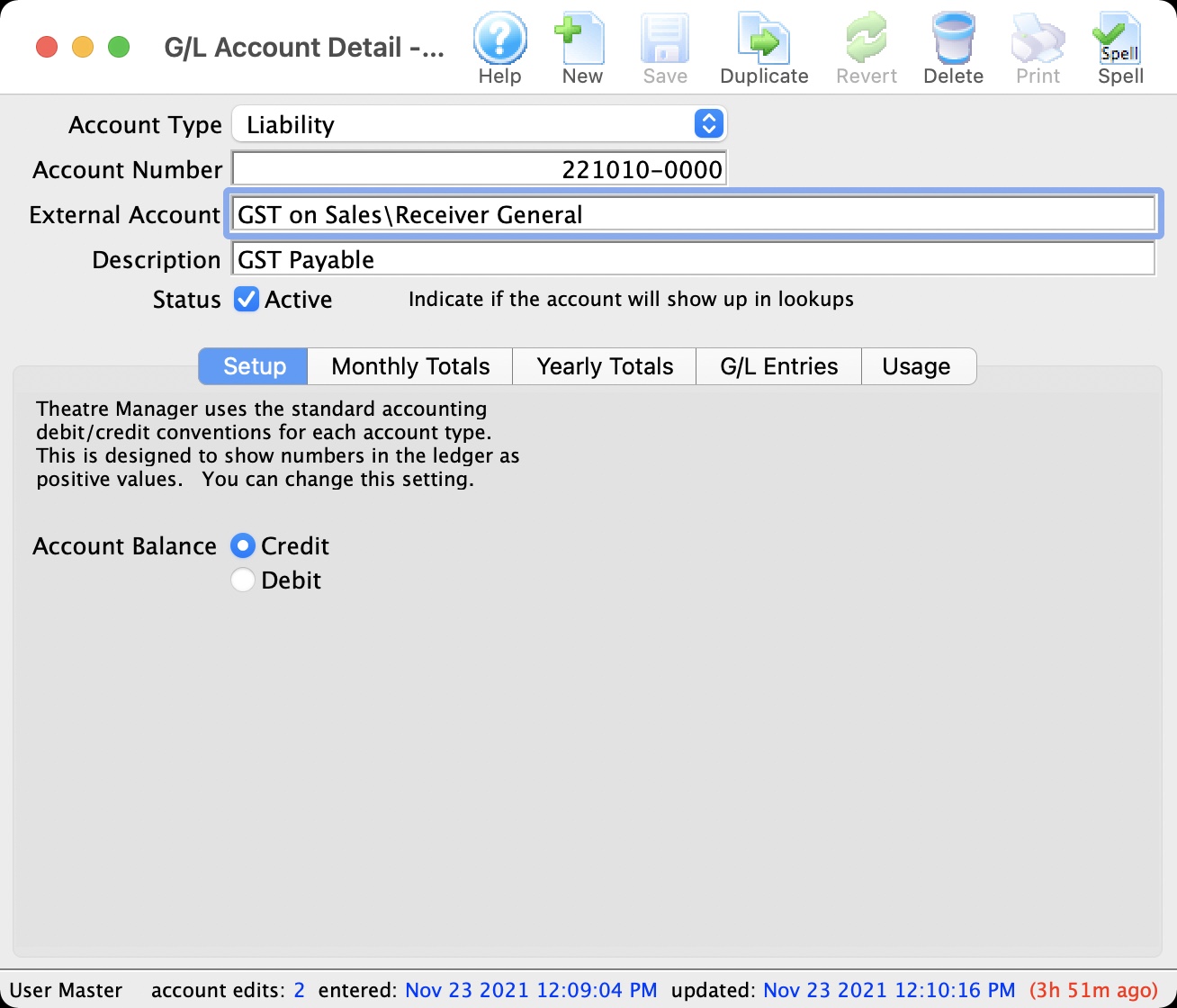

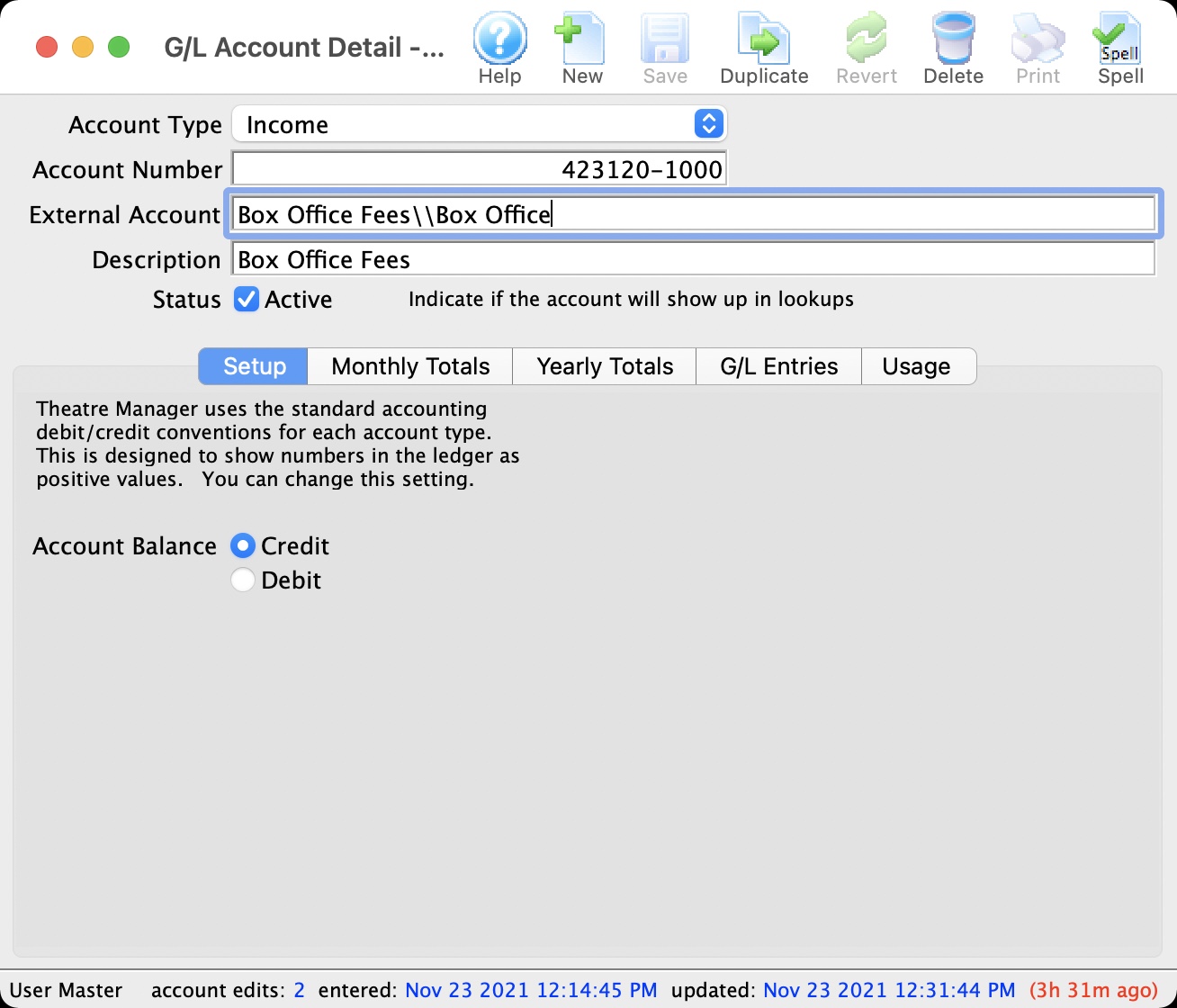

Formatting the External Account Number

Theatre Manager's External Account number are required to be set up in a specific format to accomodate the various aspects of the iCity export file.

|

The format of the External Account varies based on the purpose of the GL Account. The format of this field is required to have a backslash (\) used as separator between fields. A leading or trailing backslash (\) for the External Account field should not be added.

|

| Fund | F01 - A predefined Fund ID within iCity. |

| Class | C2 - A predefined Class ID within iCity. |

| GL Department / Category | D710000 - A predefined Department / Category ID within iCity. |

| Object | A64220 - The account number that transactions get posted to. |

MUNIS Systems

MUNIS Systems, Standard Long Account Format

MUNIS Systems, standard Long Account Format creates a .csv (text file, comma delimited) file that can be directly opened in MUNIS with no need for conversion.

QuickBooks Desktop

|

Quickbooks Online has a different IIF format than Quickbooks Desktop. Please refer the help page for the version of Quickbooks that you are using.

Neither version accepts the format of the other. |

|

For step by step instructions on importing IIF files into QuickBooks, visit the QuickBooks Community at Learning how to import Intuit Interchange Format (.IIF) files into QuickBooks. |

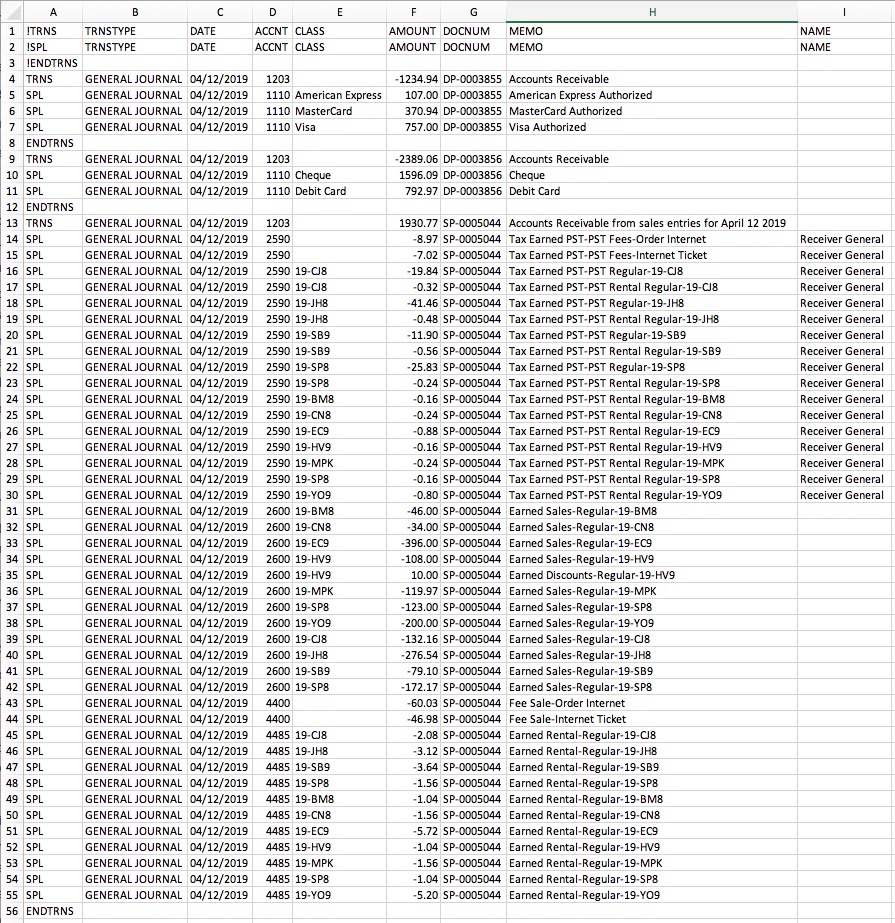

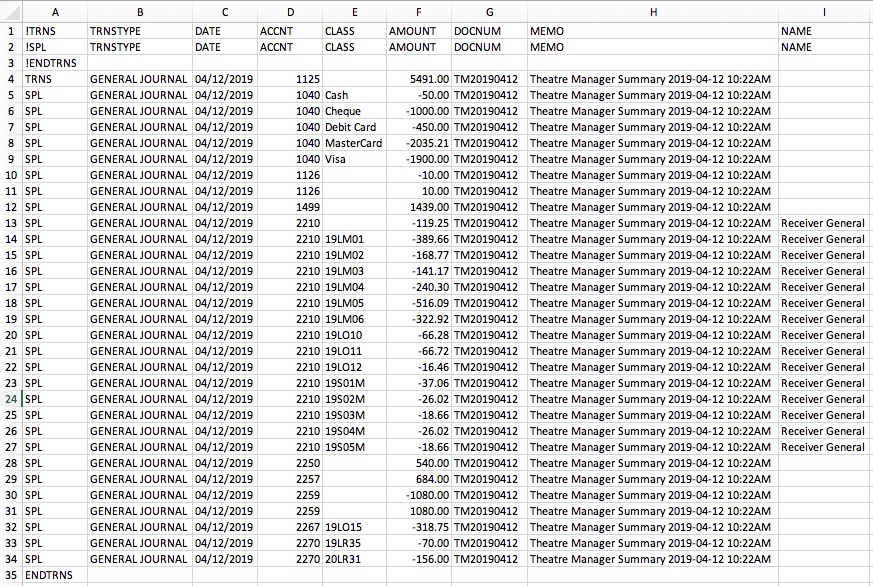

QuickBooks Desktop Pro - Detail

The QuickBooks - Detail export exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entries within the export file. This allows an exact match of each GL entry to crossover into QuickBooks (line for line).

QuickBooks Desktop Pro - Summary

The QuickBooks - Summary export creates a summarized version of the deposit and sales postings for each posting date. The deposit and sales postings lines are summarized into a single entry for each posting date within the export file.

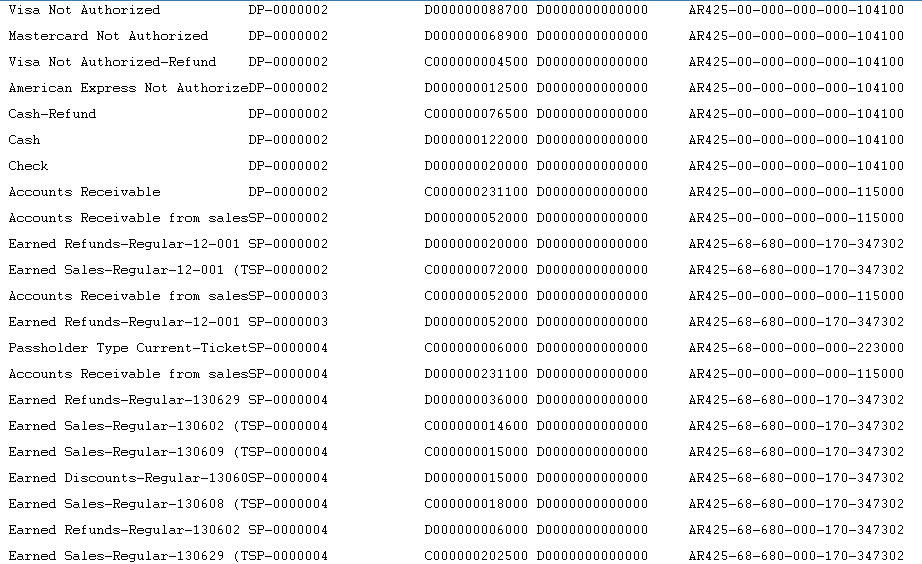

Parts of the QuickBooks Export File

| TRNS | The keyword for a transaction.

|

||||

| TRNSTYPE | A keyword that identifies the type of transaction.

|

||||

| DATE |

|

||||

| ACCNT | The name or account number of the QuickBook's account. Theatre Manager's External Account value (name or number) will be used to create the export file.

|

||||

| CLASS | The name of the class that applies to the transaction.

|

||||

| AMOUNT | The amount of the transaction. Debit amounts are always positive, credit amounts are always negative. | ||||

| DOCNUM | Journal Entry Reference Number.

|

||||

| MEMO | The memo text associated with the transaction.

|

||||

| NAME | The name of the Agency Vendor.

|

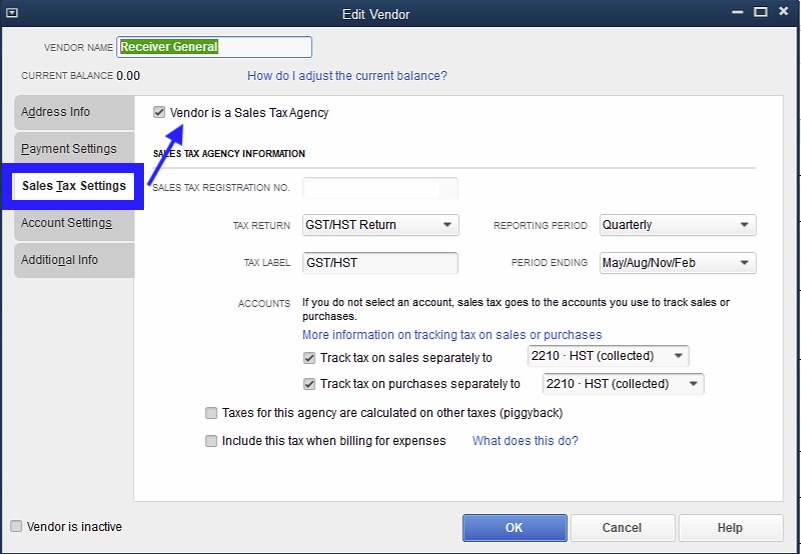

Vendor is a Sales Tax Agency

In QuickBooks, you may have set a Vendor as a Sales Tax Agency for your tax account(s).

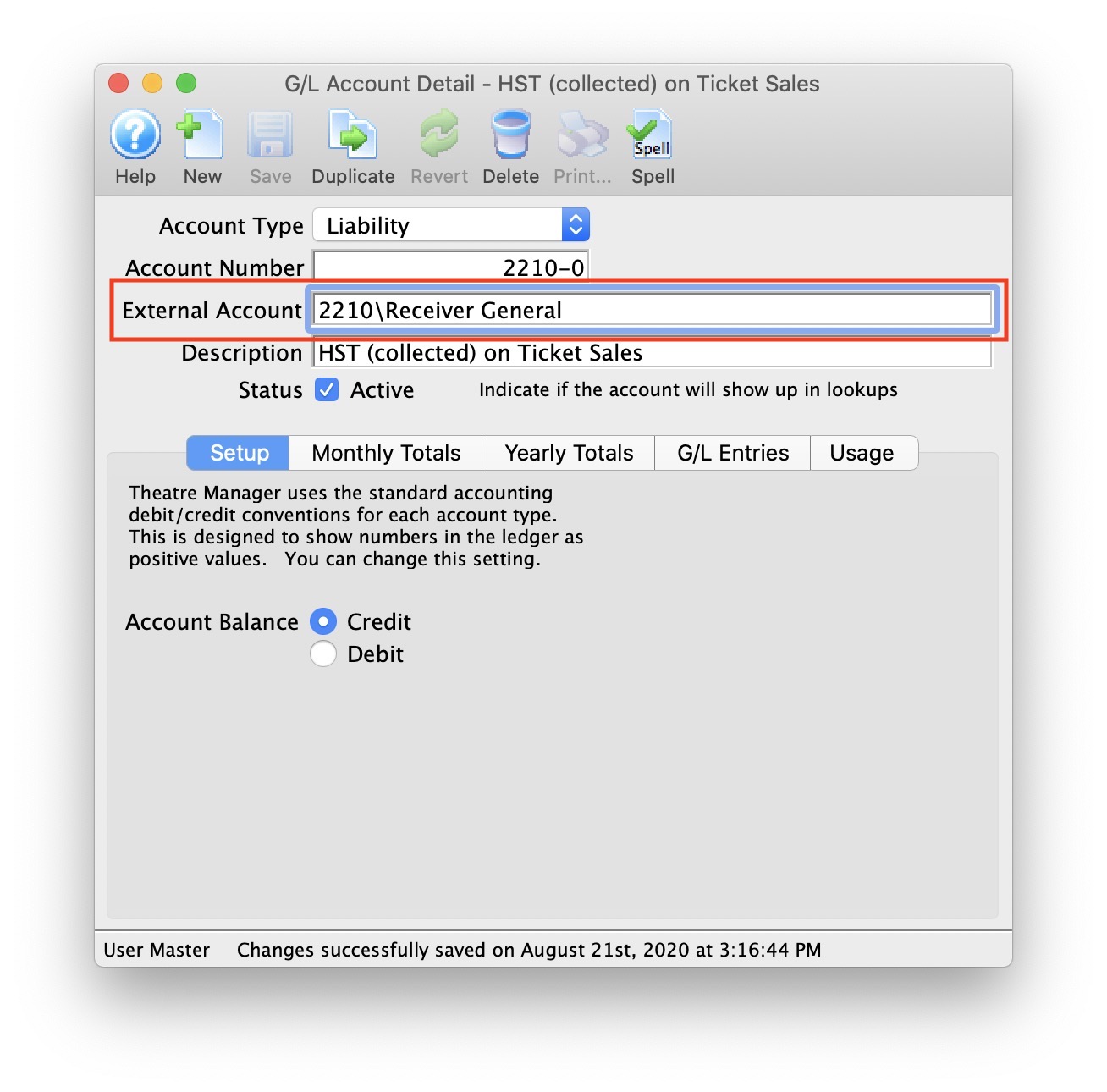

If QuickBooks is set up in this manner, the following example illustrates how to set up the External Account description. It must be set as [AccountNameOrNumber]\[VendorName] where a backslash (\) separates the 2 fields.

|

During the export process, the External Account field will be automatically parsed into the 2 separate values for ACCNT and NAME when a backslash (\) is within the External Account field. |

Common Questions

|

QB IIF: TRNSTYPE error - if you receive this error during the QuickBook's import process, it means you have set Theatre Manager to use the incorrect QuickBook's version that you are using. The TRNSTYPE, is a keyword that identifies the type of transaction.

|

|

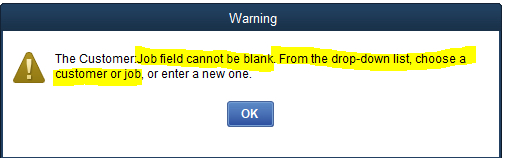

QuickBooks has a requirement that a valid Customer/Vendor is included when posting to the built-in Accounts Receivable or Accounts Payment accounts. QuickBooks can not assign a receivable or a payable to 'nobody', it requires a Customer/Vender that is previously set up within QuickBooks.

The solution is as simple as avoiding any postings directly to the QuickBooks account types of Accounts Receivable and Accounts Payable. Rather, create a separate standard (non A/R) asset account and call it (for example) "A/R for Theatre Manager" and separate liability account and call it (for example) "A/P for Theatre Manager" and reference those account numbers in Theatre Manager's External Account value (name or number) used to create the export file. This way, there is no need to maintain Customers/Payees/Vendors in the export file as these accounts are just standard Asset / Liability and not linked to a special account type. This way when you import the amount into QuickBooks, it will go against the standard asset account and not against the built-in accounts receivable account in QuickBooks. When you want to see the details that make up the "A/R for Theatre Manager" or the "A/P for Theatre Manager" account, go directly to Theatre Manager for the details, rather than QuickBooks. To recap, create a standard Asset & and a standard Liability account to use to post to in QuickBooks. |

QuickBooks Online

|

Quickbooks Desktop has a different IIF format than Quickbooks Online. Please refer the help page for the version of Quickbooks that you are using.

Neither version accepts the format of the other. |

|

For step by step instructions on importing CSV or Excel files into QuickBooks, visit QuickBooks Support at Import Journal Entries in QuickBooks Online. |

|

QuickBooks help may say to turn off account numbers in Quickbooks. DO NOT TURN THEM OFF.

While Quickbooks indicates is able to match on either Account Name or Account Number, it is simply too much effort to keep account name matching character for character. Theatre Manager places the contents of the External Account field in the export file. This is the best to match TM accounts to Quickbooks using a field that generally should never change. |

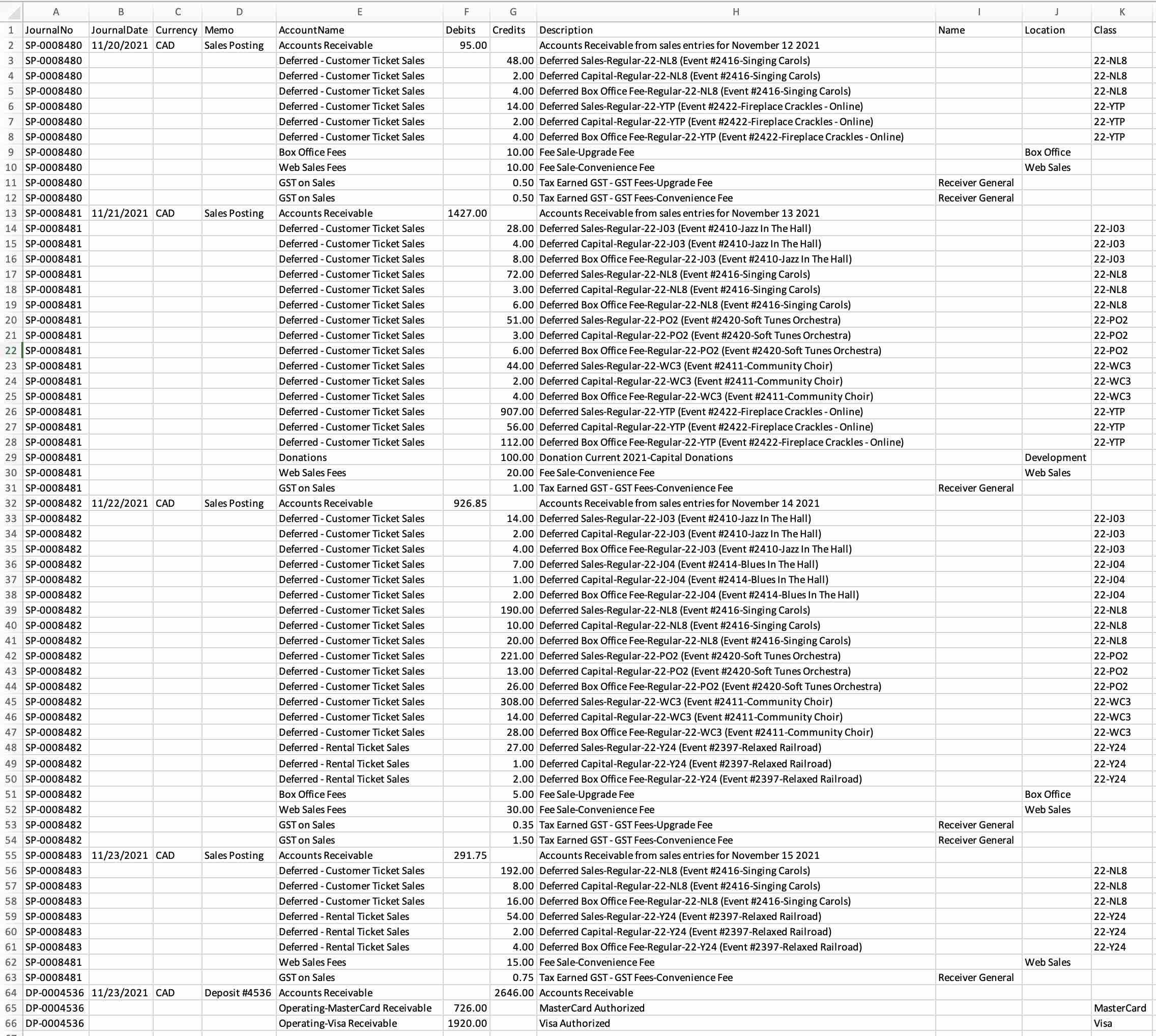

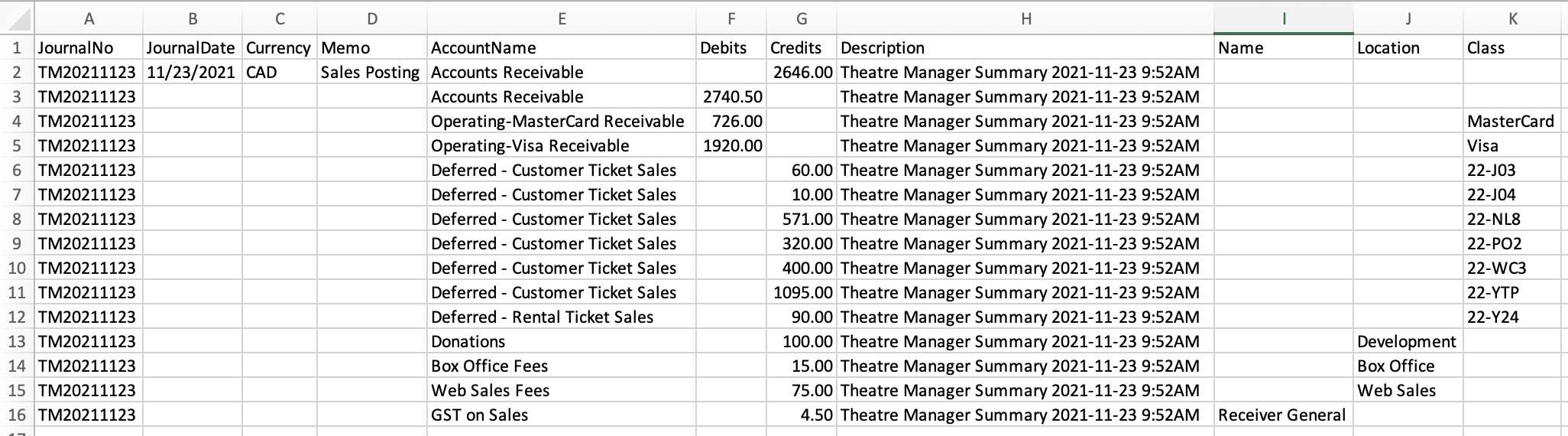

QuickBooks Online - Detail

The QuickBooks - Detail export exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entries within the export file. This allows an exact match of each GL entry to crossover into QuickBooks (line for line).

QuickBooks Online - Summary

The QuickBooks - Summary export creates a summarized version of the deposit and sales postings for each posting date. The deposit and sales postings lines are summarized into a single entry for each posting date within the export file.

Parts of the QuickBooks Export File

| JournalNo | Journal Entry Reference Number.

|

||||

| JournalDate |

|

||||

| Currency | A valid Currency Code. Required for multi-currency databases.

| ||||

| Memo | The Journal Entry Description for this G/L Entry (Sales Posting, Deposit Posting). | ||||

| AccountName | The name or account number of the QuickBook's account. Theatre Manager's External Account value (name or number) will be used to create the export file.

|

||||

| Debits | The Debit Amount of the transaction. | ||||

| Credits | The Credit Amount of the transaction. | ||||

| Description | The memo text associated with the transaction.

|

||||

| Name | The name of the Agency Vendor.

|

||||

| Location | The location of the transaction.

|

||||

| Class | The name of the class that applies to the transaction.

|

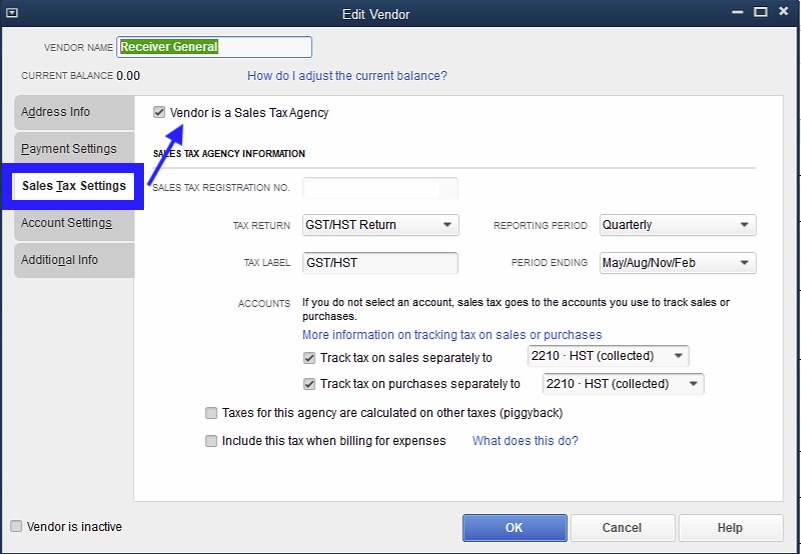

Vendor is a Sales Tax Agency

In QuickBooks, you may have set a Vendor as a Sales Tax Agency for your tax account(s).

If QuickBooks is set up in this manner, the following example illustrates how to set up the External Account description. It must be set as [AccountNameOrNumber]\[VendorName]\[Location] where a backslash (\) separates the 3 fields.

|

During the export process, the External Account field will be automatically parsed into the 3 separate values for AccountName, Name, and Location when a backslash (\) is within the External Account field. |

Location Tracking

In QuickBooks, you may have enabled Location tracking.

If QuickBooks is set up in this manner, the following example illustrates how to set up the External Account description. It must be set as [AccountNameOrNumber]\[VendorName]\[Location] where a backslash (\) separates the 3 fields.

|

During the export process, the External Account field will be automatically parsed into the 3 separate values for AccountName, Name, and Location when a backslash (\) is within the External Account field. |

Common Questions

|

QuickBooks has a requirement that a valid Customer/Vendor is included when posting to the built-in Accounts Receivable or Accounts Payment accounts. QuickBooks can not assign a receivable or a payable to 'nobody', it requires a Customer/Vender that is previously set up within QuickBooks.

The solution is as simple as avoiding any postings directly to the QuickBooks account types of Accounts Receivable and Accounts Payable. Rather, create a separate standard (non A/R) asset account and call it (for example) "A/R for Theatre Manager" and separate liability account and call it (for example) "A/P for Theatre Manager" and reference those account numbers in Theatre Manager's External Account value (name or number) used to create the export file. This way, there is no need to maintain Customers/Payees/Vendors in the export file as these accounts are just standard Asset / Liability and not linked to a special account type. This way when you import the amount into QuickBooks, it will go against the standard asset account and not against the built-in accounts receivable account in QuickBooks. When you want to see the details that make up the "A/R for Theatre Manager" or the "A/P for Theatre Manager" account, go directly to Theatre Manager for the details, rather than QuickBooks. To recap, create a standard Asset & and a standard Liability account to use to post to in QuickBooks. |

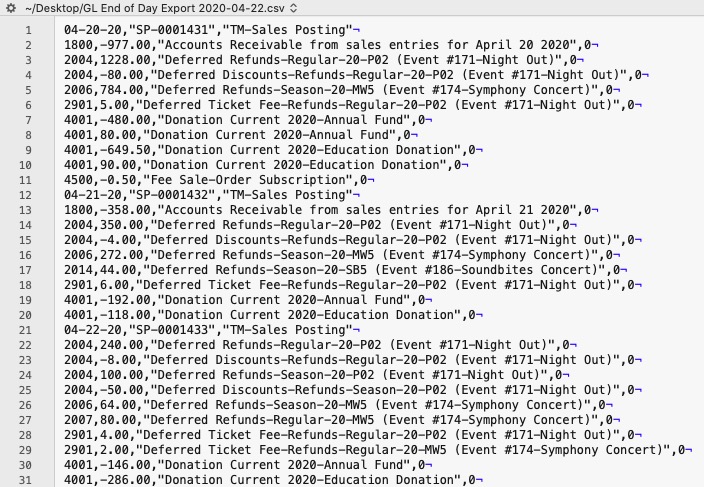

Sage 50 Accounting

Sage 50 Accounting Software

The Sage 50 Accounting Software exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entry within the export file. This allows an exact match of each G/L Entry to crossover into Sage 50 Accounting (line for line).

Parts of the Sage 50 Export File - Header Record

| Date | The Journal Entry Date. The date is always in MM-DD-YY format. |

| Source | Journal Entry Reference Number. The Journal Number from the sales posting or deposit posting will be exported. The field is limited to 13 characters. |

| Comment | Journal Entry Description.

|

Parts of the Sage 50 Export File - Detail Record

| Account Number | Theatere Manager's External Account value (name or number) will be used to create the export file. |

| Amount | The debit amount (represented as a positive value) or the credit amount (represented as a negative value) of the transaction. |

| Comment | The memo text associated to this particular G/L transaction from Theatre Manager's journal entry. The field is limited to 160 characters. |

| Project Allocation | The number of project allocation lines that follow this GL Account transation. The value will default to "0" as Theatre Manager will not be allocating the Amount for each Account Number. |

Common Questions

|

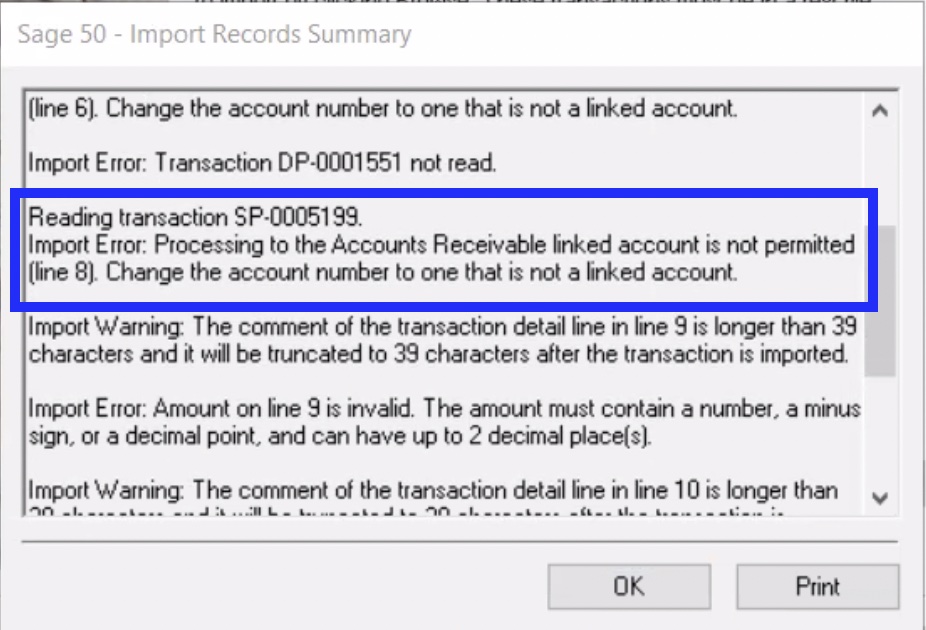

Sage 50 has a requirement its data import routines are unable to import transactions that affect the linked Accounts Receivable, Accounts Payable, Payroll Advances, Vacation Payable, or Inventory accounts if you have finished entering history.

The solution is as simple as avoiding any postings directly to the Sage 50 account types of Accounts Receivable and Accounts Payable. Rather, create a separate standard (non A/R) asset account and call it (for example) "A/R for Theatre Manager" and separate liability account and call it (for example) "A/P for Theatre Manager" and reference those account numbers in Theatre Manager's External Account value (name or number) used to create the export file. This way when you import the amount into Sage 50, it will go against the standard Asset / Liability account and not against the built-in accounts receivable account in Sage 50. When you want to see the details that make up the "A/R for Theatre Manager" or the "A/P for Theatre Manager" account, go directly to Theatre Manager for the details, rather than Sage 50. To recap, create a standard Asset and standard Liability account to use to post to in Sage 50. |

Sage Accpac

Sage Accpac Version 5.6

Sage ACCPAC Version 5.6 creates a .csv (text file comma delimited) file that can be opened directly in ACCPAC 5.6 and higher with no need for conversion.Sage Intacct

|

Theatre Manager will create a comma-delimited text file (.csv) that can be used to import into Sage Intacct accounting software. Sage Intacct's ability to create unique accounts, locations, departments, and classes for each GL account requires the setup of Theatre Manager's External Account field to be set in a specific format to accomodate the various aspects of the Intacct export file, prior to performing the first export. |

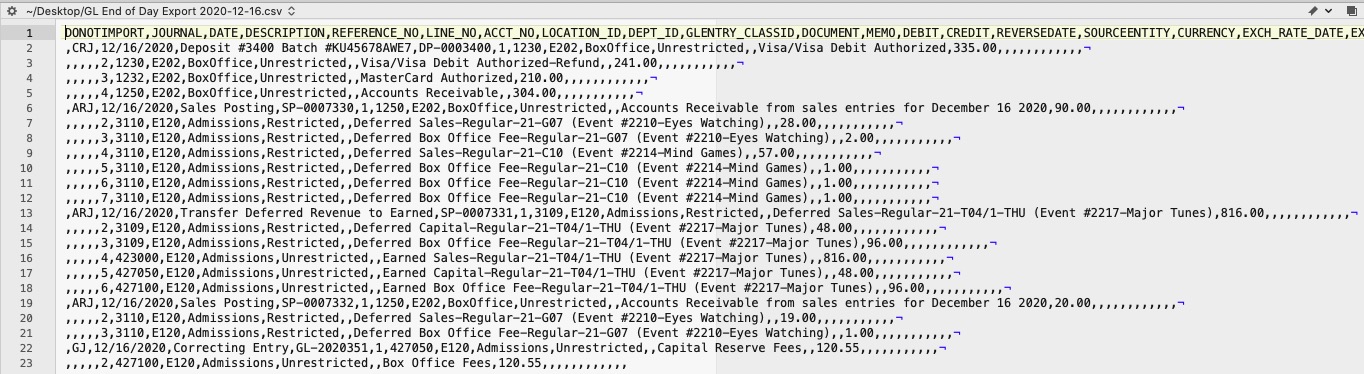

Sage Intacct

The Sage Intacct exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entry within the export file. This allows an exact match of each G/L Entry to crossover into Intacct (line for line).

Parts of the Sage Intacct Export File

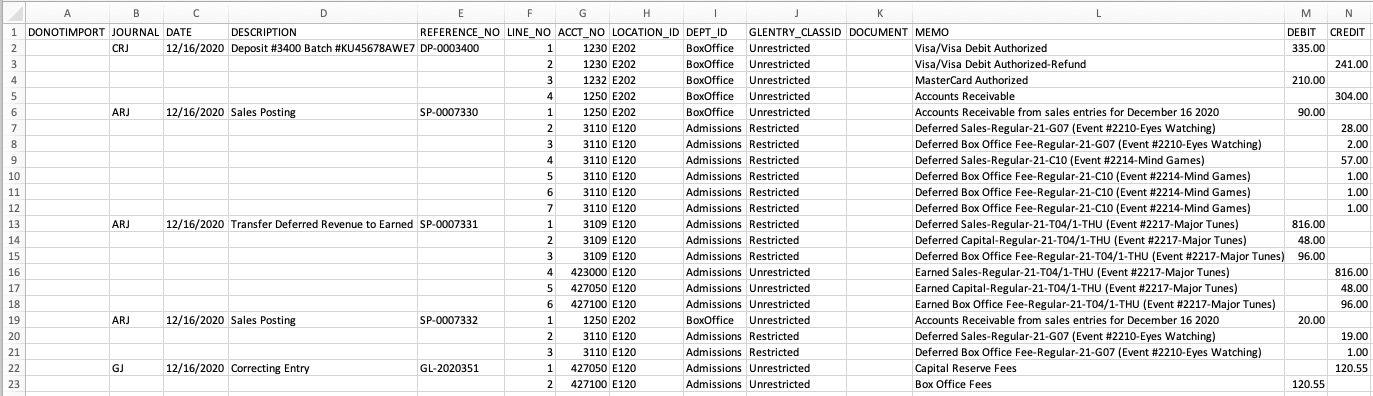

| DONOTIMPORT | Do Not Import flag - Any row which starts with a # will be ignored during the Intacct import.

Theatre Manager does not populate this field during the export process. |

||||

| JOURNAL | A valid Journal Type within Intacct representing the type of journal entry. The field is limited to 4 characters.

|

||||

| DATE | The Journal Entry Date for this G/L Entry. The date will be in a MM/DD/YYYY format. | ||||

| DESCRIPTION | The Journal Entry Description for this G/L Entry (Sales Posting, Deposit Posting). The field is limited to 80 characters. | ||||

| REFERENCE_NO | Journal Entry Reference Number. The Journal Number for this G/L Entry (SP-0001318, DP-0001255, GL-2020351). | ||||

| LINE_NO | A sequential Line Counter for each exported entry line. Line numbers begin at 1 and increment by 1 for each associated entry line. The Line Counter ID will reset back to 1 again for each new Sales Posting, Deposit Posting, or G/L Entry exported. | ||||

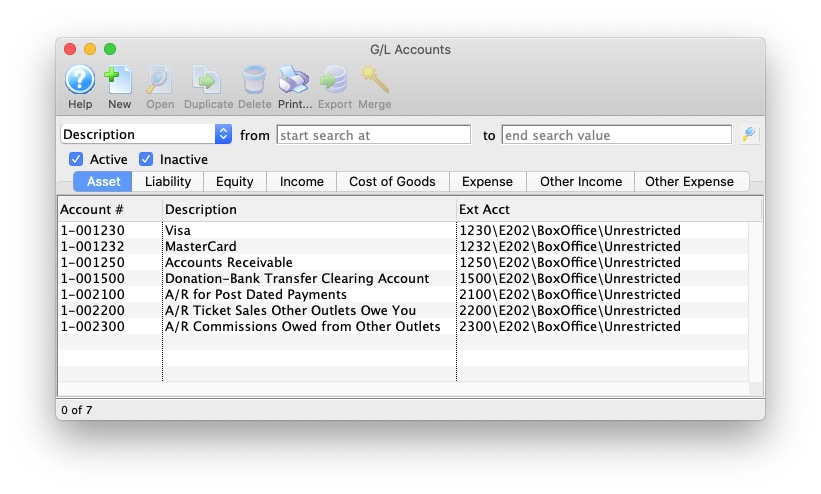

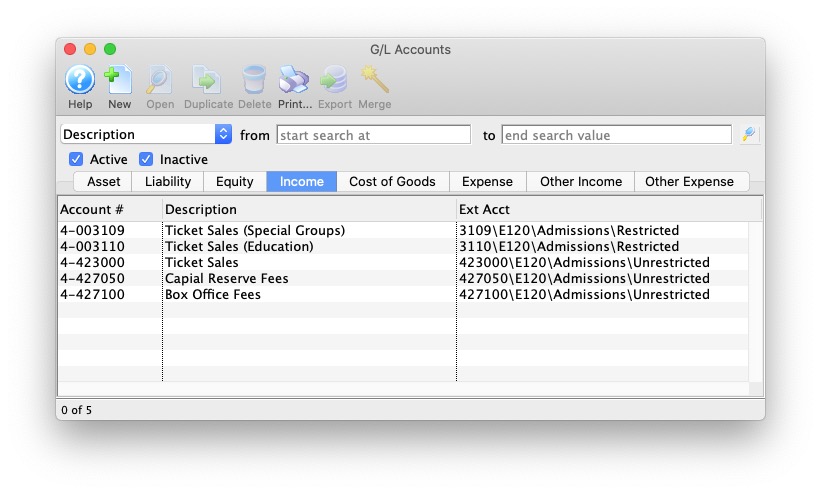

| ACCT_NO | The Intacct account number. Theatere Manager's External Account value (name or number) will be used to create the export file. | ||||

| LOCATION_ID | An associated Location ID to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file. | ||||

| DEPT_ID | An associated Department ID to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file. | ||||

| GLENTRY_CLASSID | An associated Class ID to the Account Number. Theatre Manager's External Account value (name or number) will be used to create the export file. | ||||

| DOCUMENT | The Document Reference for this G/L Detail Line. The field is limited to 30 characters.

Theatre Manager does not populate this field during the export process. |

||||

| MEMO | The memo text for this G/L Detail Line. The field is limited to 1000 characters. | ||||

| DEBIT | The debit amount for this G/L Detail Line. A blank value is used for $0.00 amounts. | ||||

| CREDIT | The credit amount for this G/L Detail Line. A blank value is used for $0.00 amounts. | ||||

| REVERSEDATE | The Reverse Date for this G/L Entry. The date will be in a MM/DD/YYYY format.

Theatre Manager does not populate this field during the export process. |

||||

| SOURCEENTITY | Refers to a valid Location within Intacct. The field is limited to 20 characters.

Theatre Manager does not populate this field during the export process. |

||||

| CURRENCY | A valid Currency ID within Intacct. The field is limited to 40 characters.

Theatre Manager does not populate this field during the export process. |

||||

| EXCH_RATE_DATE | The Exchange Rate Date indicator for this G/L Entry. The date will be in a MM/DD/YYYY format.

Theatre Manager does not populate this field during the export process. |

||||

| EXCH_RATE_TYPE_ID | A valid Exchange Rate Type ID within Intacct. The field is limited to 40 characters.

Theatre Manager does not populate this field during the export process. |

||||

| EXCHANGE_RATE | The Exchange Rate for this G/L Entry. The field is limited to 17 characters, not including decimal point.

Theatre Manager does not populate this field during the export process. |

||||

| STATE | The current State indicator for the G/L Entry.

Theatre Manager does not populate this field during the export process. |

||||

| ALLOCATION_ID | A valid Allocation ID within Intacct. The field is limited to 50 characters.

Theatre Manager does not populate this field during the export process. |

||||

| BILLABLE | The Billable for this G/L Entry.

Theatre Manager does not populate this field during the export process. |

||||

| GLENTRY_CUSTOMERID | A valid Customer ID within Intacct. The field is limited to 20 characters.

Theatre Manager does not populate this field during the export process. |

||||

| GLENTRY_VENDORID | A valid Vendor ID within Intacct. The field is limited to 20 characters.

Theatre Manager does not populate this field during the export process. |

Formatting the External Account Number

Theatre Manager's External Account number are required to be set up in a specific format to accomodate the various aspects of the Sage Intacct export file.

|

The format of the External Account varies based on the purpose of the GL Account. The format of this field is required to have a backslash (\) used as separator between fields. A leading or trailing backslash (\) for the External Account field should not be added.

|

| ACCT_NO | A23456789 - The account number that transactions get posted to.

|

||

| LOCATION_ID | L2345 - A predefined Location ID within Intacct. This ID is only required if Intacct requires it when using this account number. | ||

| DEPT_ID | D23456 - A predefined Department ID within Intacct. This ID is only required if Intacct requires it when using this account number. | ||

| GLENTRY_CLASSID | C23456 - A predefined Class ID within Intacct. This ID is only required if Intacct requires it when using this account number. |

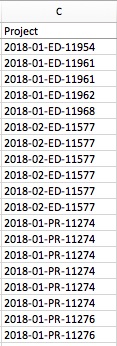

Solomon

|

Theatre Manager will create a Microsoft Excel file that can be used to import into Solomon Accounting Software. Solomon's ability to create unique company names, accounts, projects, tasks, and sub accounts for each GL account requires the setup of Theatre Manager's External Account field to be set in a specific format to accomodate the various aspects of the Solomon export file, prior to performing the first export. |

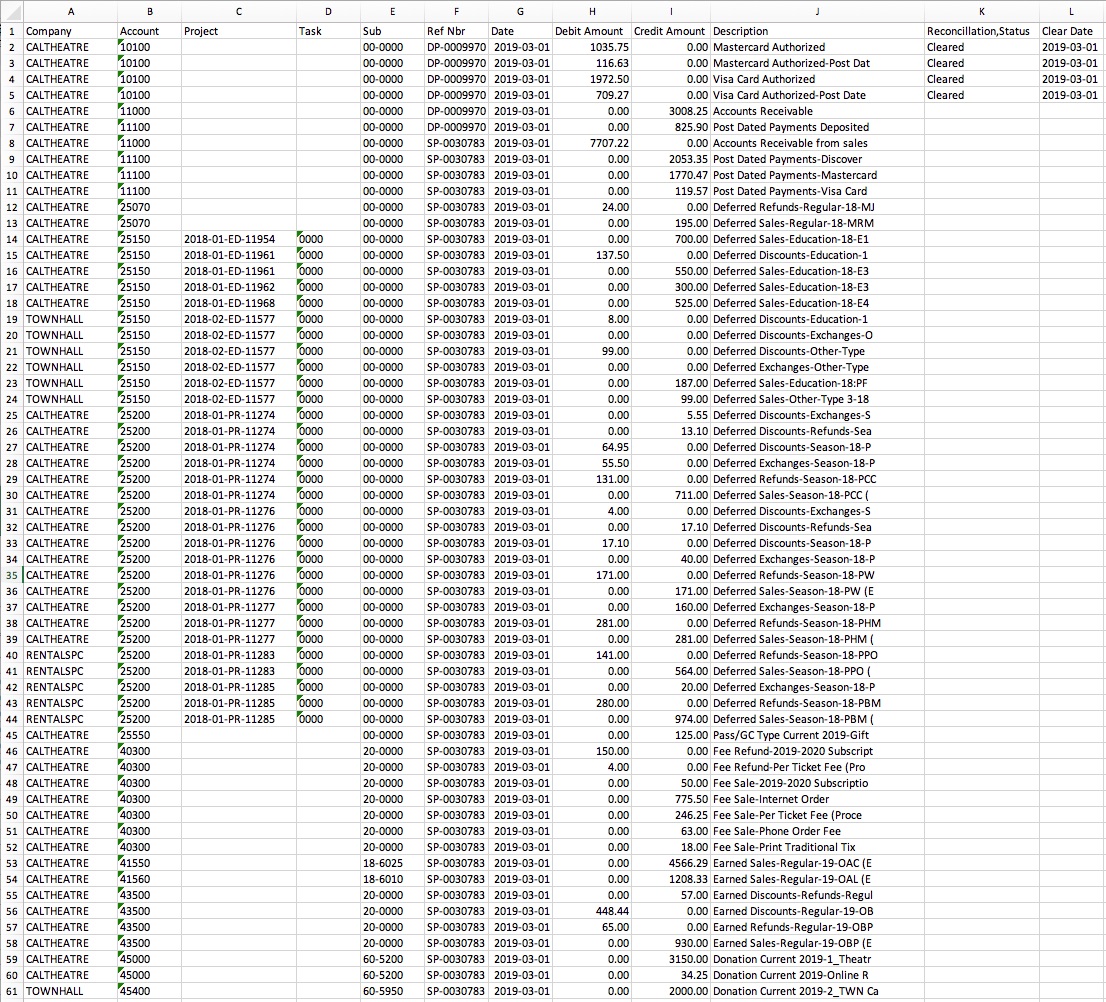

Solomon Accounting Software

The Soloman Accounting Software exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entry within the export file. This allows an exact match of each G/L Entry to crossover into Solomon (line for line).

Parts of the Solomon Export File

| Company | The 'company database' that transactions get posted to. This description is defined within Solomon and may not match anything within Theatre Manager.

|

||||

| Account | A 5 digit account number. Theatere Manager's External Account value (name or number) will be used to create the export file. | ||||

| Project | Project codes are setup within Solomon. Using Theatere Manager's External Account, the export process will create the Project code for each event's sales. Refer to the section The Project Field Format on this page for more information.

|

||||

| Task | A 4 digit number. Task numbers are setup in Solomon.

|

||||

| Sub | A 6 digit sub account number. Sub account numbers are setup in Solomon. | ||||

| Ref Nbr | Journal Entry Reference Number. The Journal Number from the sales posting or deposit posting will be exported. | ||||

| Date | The Journal Entry Date. The date is always in YYYY-MM-DD format. | ||||

| Debit Amount | The debit amount of the transaction. | ||||

| Credit Amount | The credit amount of the transaction. | ||||

| Description | The memo text associated to this particular G/L transaction from Theatre Manager's journal entry. The field is limited to 30 characters. | ||||

| Reconcillation,Status | A reference to the reconcillation status for the bank deposit. This field is defaulted to aide in validating and importing data into Solomon.

|

||||

| Clear Date | The date the transaction is cleared in Solomon. The date is always in YYYY-MM-DD format.

|

Formatting the External Account Number

Theatre Manager's External Account number requires to be set up in a specific format to accomodate the various aspects of the Solomon export file.

|

The format of the External Account varies based on the purpose of the GL Account. The format of this field is required to have a period (.) used as separator between fields. A leading or trailing period (.) for the External Account field should not be added. |

- (Events with Projects) The field formation will be A23456789.B2345.C23456.L2.T2

- (Events with No Projects) The field formation will be A23456789.B2345.C23456

- (Cash Type Transactions) The field formation will be A23456789.B2345.C23456.CASH

| Company | A23456789 - The 'company database' that transactions get posted to. | ||

| Account | B2345 - A 5 digit account number. | ||

| Sub | C23456 - A 6 digit sub account number.

|

||

| Location | L2 - A 2 digit code representing the Location where the event is taking place. | ||

| Event Type | T2 - A 2 character code representing the Type of Event. | ||

| Cash Type Transaction | CASH - Include CASH to represent this is a Cash Type account number. |

The Project Field Format

Theatre Manager will create a Project code using the following contents:

|

The format of the Project field will always be Y234-L2-T2-E2345 using a dash (-) as a field separator. |

| Program Year | Y234 - The Event Season starting year assigned to the Event in Theatre Manager. |

| Location | L2 - The 2 digit code representing the Location where the event is taking place, as defined in the External Account for the Event. |

| Event Type | T2 - The 2 character code representing the Type of Event, as defined in the External Account for the Event. |

| Event # | E2345 - A 5 digit number representing the Event Sequence Number assigned to the event by Theatre Manager. |

Unit4 Business World

|

Theatre Manager will create a fixed position text file (.txt) that can be used to import into Unit4 Business World accounting software. Unit4 Business World's ability to create unique accounts, locations, departments, and classes for each GL account requires the setup of Theatre Manager's External Account field to be set in a specific format to accomodate the various aspects of the Unit4 Business World export file, prior to performing the first export. |

Unit4 Business World

The Unit4 Business World (formerly Agresso Financials) exports each detail line within the G/L Entry. This allows an exact match of each G/L Entry to crossover into Unit4 Business World (line for line).

Parts of the Unit4 Business World Export File

| Batch Name | A pre-defined Batch Name identifier within Unit4 Business World representing the source of the journal entry. The field is limited to 7 characters.

| ||||

| Transaction Series | A pre-defined Transaction Series code within Unit4 Business World representing the type of journal entry.

| ||||

| GL Account Code | The Unit4 Business World account number. Theatere Manager's External Account value (name or number) will be used to create the export file. | ||||

| Cost Centre | Mandatory - A valid Cost Centre within Unit4 Business World. The field is limited to 4 characters. Theatre Manager's External Account value (name or number) will be used to create the export file. | ||||

| Project | Optional - A valid Project within Unit4 Business World. The field is limited to 16 characters. Theatre Manager's External Account value (name or number) will be used to create the export file. | ||||

| Location | Optional - A valid Location within Unit4 Business World. The field is limited to 8 characters. Theatre Manager's External Account value (name or number) will be used to create the export file. | ||||

| Payment Type | Optional - A valid Payment Type within Unit4 Business World. The field is limited to 11 characters. Theatre Manager's External Account value (name or number) will be used to create the export file.

|

||||

| Fund | Mandatory - A valid Fund within Unit4 Business World. The field is limited to 4 characters. Theatre Manager's External Account value (name or number) will be used to create the export file. | ||||

| Revenue Type | Optional - A valid Revenue Type within Unit4 Business World. The field is limited to 8 characters. Theatre Manager's External Account value (name or number) will be used to create the export file. | ||||

| Currency | A valid Currency Type ID within Unit4 Business World. The field is limited to 4 characters.

| ||||

| Data Type | Sets a preference value used during the import process to allow the import routines to know the Data Types that will be included within the import tables.

|

||||

| Amount in Local Currency | The amount of the transaction. Debit amounts are always positive, credit amounts are always negative. | ||||

| Amount in Local Currency if converted to Foreign Currency | The amount of the transaction. Debit amounts are always positive, credit amounts are always negative.

Theatre Manager sets this value to be the same as the Amount in Local Currency. |

||||

| Account Description | The G/L Account Description for this G/L Account. The field is limited to 50 characters. | ||||

| Period Start | The Journal Entry Date for this G/L Entry. The date will be in a YYYYMMDD format. | ||||

| Period End | The Journal Entry Date for this G/L Entry. The date will be in a YYYYMMDD format. |

Formatting the External Account Number

Theatre Manager's External Account number are required to be set up in a specific format to accomodate the various aspects of the Unit4 Business World export file.

|

The format of the External Account varies based on the purpose of the GL Account. The format of this field is required to have a backslash (\) used as separator between fields. A leading backslash (\) for the External Account field should not be added.

|

| GL Account Code | 4190 - The account number that transactions get posted to. The account number is mandatory. |

| Cost Centre | 3205 - A predefined Cost Centre within Unit4 Business World. This ID is mandatory. |

| Project | 112204 - A predefined Project within Unit4 Business World. This ID is optional. |

| Location | 999 - A predefined Location within Unit4 Business World. This ID is optional. |

| Revenue Type | 888 - A predefined Revenue Type within Unit4 Business World. This ID is optional. |

| Payment Type | 777 - A predefined Payment Type within Unit4 Business World. This ID is optional. |

| Fund | 100 - A predefined Fund within Unit4 Business World. This ID is mandatory. |