You are here

Credit Card Authorization Setup

Theatre Manager provides a connection to a number of service providers for credit card authorization, along with two modes of operating each option (schedule "C" or Schedule "D" compliance mode). Both are PCI PA-DSS 3.2.1 verified.

More information on Credit Card installation, setup, USB credit card swipes, PCI compliance, and card encryption can be found by clicking here.

Definitions

There is often confusion between the purpose of a bank and a service provider and understanding the difference helps make sense of the authorization options available to you.

- Bank:

- A bank is where the money ends up at the end of the day. If somebody gives you money in any form (cash, check, credit card), you write up deposit slips and take it to the building at the corner on the main street. Banks are very bricks and mortar companies with charters to write loans, put your money is a safe, etc.

- Service Provider:

- A service provider is not a bank. Service providers are only in the business of authorizing credit cards on behalf of a bank and hold on to the money while it is electronically in transit to your bank. When you do your daily credit card batch settlement, the money in transit is transferred directly to your bank. In North America, there are about 15 major service providers such as Paymentech, Nova, 1st Data, Visanet, FMDS, etc. Some banks prefer working with some service providers - but generally, most service providers can get your money to any bank.

The reason that service providers and banks are separate is historical. Banks started as local or regional entities in the USA. Most were not big enough to handle the infrastructure of authorizing credit cards. When cards became very popular in the 70's, they farmed out the business of authorizing cards to a service provider as an economical means of providing cards to their customers without the expense of hosting large computer centers.

Service providers provide the infrastructure to authorize cards and then deposit YOUR funds in ANY bank.

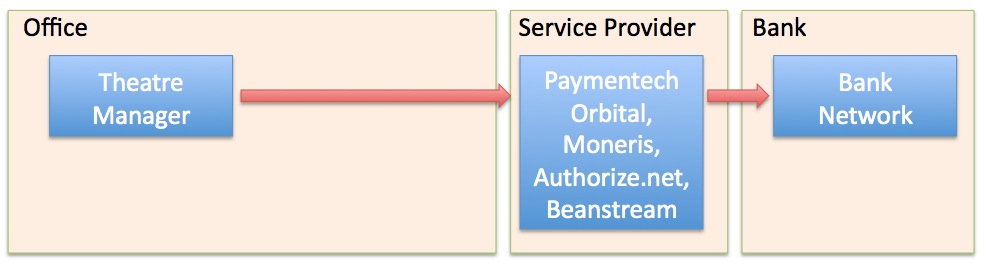

System Flow

With any service provider, the money always gets to your bank account. You enter or swipe the card information into Theatre Manager and it sends all the correct information to the appropriate service provider. The following illustrates the difference in flow of the authorization. In either case, a merchant has to maintain a PCI compliant Office setup.

Transactions Types

With each service provider, Theatre Manager supports the ability for processing:

- Payment Pre-Authorizations

- Payment Voids

- Independent Payment Refunds

- Linked Payment Refunds

- Batch Settlement